So far, we’ve explored why e-commerce accounting isn’t your average bookkeeping gig and how it breaks all the traditional rules. But today, we get into the real engine behind your business the Order-to-Cash cycle. This is where the action happens.

Think of it like this: A customer clicks “Buy Now”, and you see a new order pop up. Great! But here’s the twist the money isn’t in your bank yet. Not even close. That journey from order placement to actual cash hitting your account? It’s a winding road, full of timing gaps, processing lags, and accounting headaches.

In a traditional store, a customer pays, grabs their item, and walks out end of story. But in e-commerce, the sale is just the beginning of a complex, multi-step dance across payment gateways, shipping systems, return policies, and platform settlement timelines. The whole process can take anywhere from 24 hours to 14 days, depending on where you’re selling and how your backend is structured.

Why does this matter? Because every step of this cycle impacts your cash flow, inventory planning, revenue recognition, and ultimately your ability to scale. If you don’t fully understand what’s happening at each stage, you could be counting phantom revenue, missing refunds, or misjudging your burn rate.

And that’s what we’re here to fix let’s break it down, stage by stage.

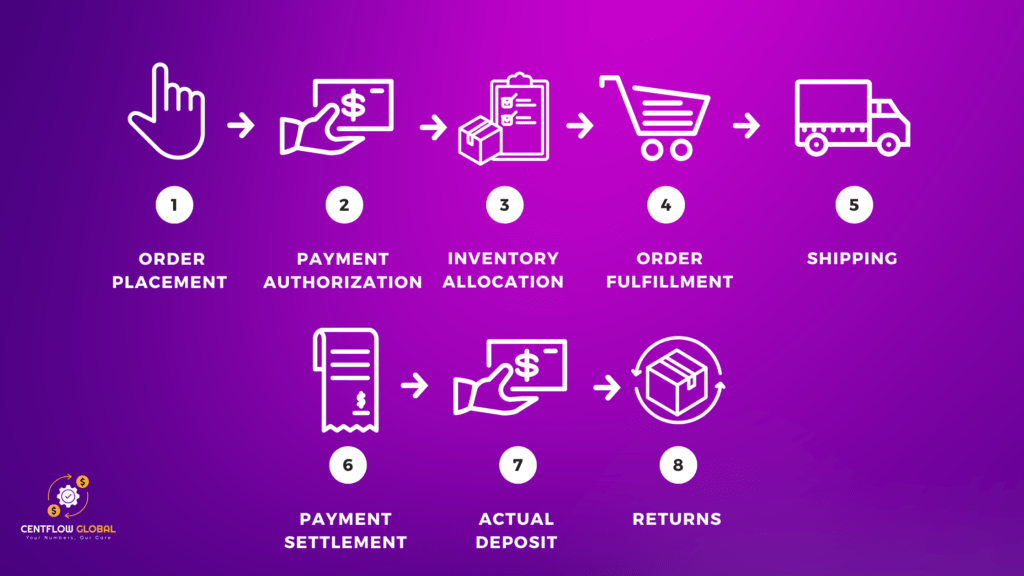

The Complete E-commerce Order-to-Cash Journey

Think of the order-to-cash cycle as the bloodstream of your e-commerce business carrying not just revenue, but risk, responsibility, and a truckload of data with it. Every click on “Buy Now” kicks off a chain reaction across your business that can stretch across eight critical stages each one with its own financial implications.

Let’s break it down, step by step:

Stage 1: Order Placement

The Digital Handshake

The moment a customer confirms a purchase, your accounting system should already be listening. Even if no money has hit your account yet, this moment triggers important financial events:

- An accounts receivable is logged for the full transaction amount (including any taxes).

- Simultaneously, you record deferred revenue because you’ve not yet delivered the product, so technically, you haven’t earned the money.

Sounds simple? Here’s the twist: If you’re selling on platforms like Amazon, eBay, or Shopify, each one reports orders and charges fees differently. Amazon might take a 15% cut; Shopify may deduct subscription and gateway fees. Your accounting system needs to make sense of these platform-specific quirks from the first click.

Stage 2: Payment Authorization

Money in Limbo

Within seconds of the order, your payment gateway (Stripe, PayPal, Amazon Pay, etc.) springs into action:

- The customer’s card is verified.

- A fraud check runs in the background.

- Funds are authorized, but not yet received.

At this stage, most accounting systems don’t record any entries. The transaction is pending, and the cash is still floating in the digital ether.

Here’s where it gets tricky: if you’re accepting payments from multiple gateways, each has its own rules, fees, and payout timing. Failing to track this can create serious reconciliation nightmares later.

Stage 3: Inventory Allocation

Locking in the Goods

Once payment is greenlit, it’s time to allocate inventory. But here’s the nuance: allocation ≠ shipping.

From an operational view, you’re reserving stock but from an accounting perspective, that stock still sits on your balance sheet as an asset. It hasn’t moved physically or financially… yet.

- You may adjust reserved stock in your inventory software.

- But Cost of Goods Sold (COGS) hasn’t hit your P&L, because the order hasn’t shipped.

For businesses operating across Amazon FBA, their own warehouse, and 3PLs? This is where real-time syncing becomes non-negotiable. Oversell, and you risk not just refunds, but a hit to customer trust and financial reporting accuracy.

The Rest of the Journey: From Fulfillment to Cash in the Bank

Once that order comes in and your systems go to work, we’re only halfway through the ride. What happens after someone clicks “Buy Now” can make or break your business’s cash flow and your sanity. Let’s break down the final steps in the e-commerce Order-to-Cash cycle.

Stage 4: Order Fulfillment – Where the Costs Get Real

This is the part where your warehouse (or your fulfillment partner) springs into action: items are picked, packed, and prepped for dispatch. But behind the scenes, a lot is happening financially too.

Once that product is out the door, your accounting software should:

- Recognize the cost of goods sold (COGS)

- Reduce inventory levels on the balance sheet

- Record fulfillment costs (packaging, shipping labels, labor, etc.)

Now, if you’re self-fulfilling orders, these costs are pretty straightforward. But if you’re using Amazon FBA or a third-party logistics partner? Brace yourself for layered fees, complicated timelines, and delayed reporting. The accounting gets spicier and a lot more important.

Stage 5: Shipping = Revenue (Usually)

This is the moment revenue recognition takes center stage. Thanks to ASC 606 (yes, that accounting standard everyone pretends to know until tax season), e-commerce revenue is typically recognized when the order is shipped, not when it’s placed or delivered.

So even if your customer already paid you, and the order’s been sitting for 24 hours, you technically haven’t earned that revenue until it’s on its way.

And don’t forget:

- Deferred revenue becomes recognized revenue

- Sales tax liabilities get locked in

This stage is what separates real-time accounting from end-of-month guesswork.

Stage 6: Payment Settlement Where You Finally Get Paid

You’ve fulfilled, shipped, and recognized revenue now where’s the cash?

This part can feel like watching paint dry.

Your payment processor (Stripe, PayPal, Amazon, etc.) holds the funds for 1 to 3 days, sometimes longer. For marketplaces like Amazon, that delay can stretch to 7–14 days even more if you’re new or flagged for review.

Here’s what your books need to reflect during this stage:

- Cash inflow to your account (net of fees)

- Settlement of outstanding accounts receivable

- Payment processing fees as an expense

This final stage is when all your hard work actually turns into bank balance. But timing here affects cash flow planning, supplier payments, and future inventory purchases so it’s not just an accounting detail. It’s survival.

Stage 7: When Cash Actually Hits Your Bank

You’ve done everything right shipped the order, recognized the revenue, the processor has released the funds… but you’re still refreshing your banking app like it owes you money (well, technically, it does).

The last step in the cycle is the actual deposit into your business account. This can take another 1-2 business days thanks to banking processes. And if you’re dealing with international payments, it’s even more complicated think currency conversions, international remittance fees, and foreign exchange risk.

This is where many founders mess up: cash in Stripe ≠ cash in the bank. And unless you’re accounting for these delays in your cash flow forecasts, you could end up short on payroll or inventory just because your deposits were late.

Stage 8: Returns The Revenue Boomerang

Returns are the silent killer of e-commerce profitability.

While traditional retail may see 5-10% return rates, e-commerce businesses regularly face 20-30% especially in categories like apparel and electronics.

Here’s what happens when a return rolls in:

- Revenue from the original order is reversed (contra-revenue entry)

- Inventory is (maybe) restocked, depending on product condition

- Cost of goods sold is also reversed

- Refunds are processed, including potential restocking fees

Smart accounting teams build return reserves based on historical data. That means, even if a return hasn’t happened yet, you’re already accounting for it in your books reducing the risk of inflated revenue figures on your P&L.

Why Revenue Recognition Isn’t So Simple

Under ASC 606, you can’t just count revenue the moment someone places an order.

You need to answer one critical question:

“Has the customer gained control of the product?”

In e-commerce, that typically means when the product ships not when the money comes in or the customer hits checkout.

This timing creates a weird disconnect:

- You may have cash in hand but can’t record revenue yet

- Or you may have recognized revenue but are still waiting for funds

If you’re not careful, these mismatches can mess with your profitability analysis, tax filings, and even investor reporting.

Why You Need Tech to Survive This Maze

This entire Order-to-Cash cycle is impossible to manage manually. You need tech not because it’s trendy, but because without it, you’ll drown in spreadsheets and errors.

Automation helps you:

- Cut manual errors by up to 90%

- Save 40–60 hours/month

- Sync data in real-time across platforms (Amazon, Shopify, Stripe, PayPal, Xero, QuickBooks, etc.)

Integrated systems don’t just save time they help you see what’s really happening in your business. For a multi-channel business, it’s the difference between operating in the dark vs. running with headlights on.

The E-commerce vs. Traditional Accounting Showdown

| Metric | Traditional Retail | E-commerce | Complexity Multiplier |

| Avg. Daily Transactions | 50–200 | 1,000–10,000+ | 20–50x |

| Payment Settlement Time | Same Day | 1–7 Days | 7x |

| Payment Methods | 3–4 | 10+ | 3x |

| Revenue Recognition | Simple (Point of Sale) | ASC 606 Rules | 5x more complex |

| Tax Jurisdictions | 1–2 | 5–50+ | 10–25x |

| Tech Integration Points | 1–2 | 5–15 | 5–10x |

| Cash Flow Delay | 0–1 Day | 3–14 Days | Up to 14x |

| Error Management | Manual Fix | Automation Essential | Exponential |

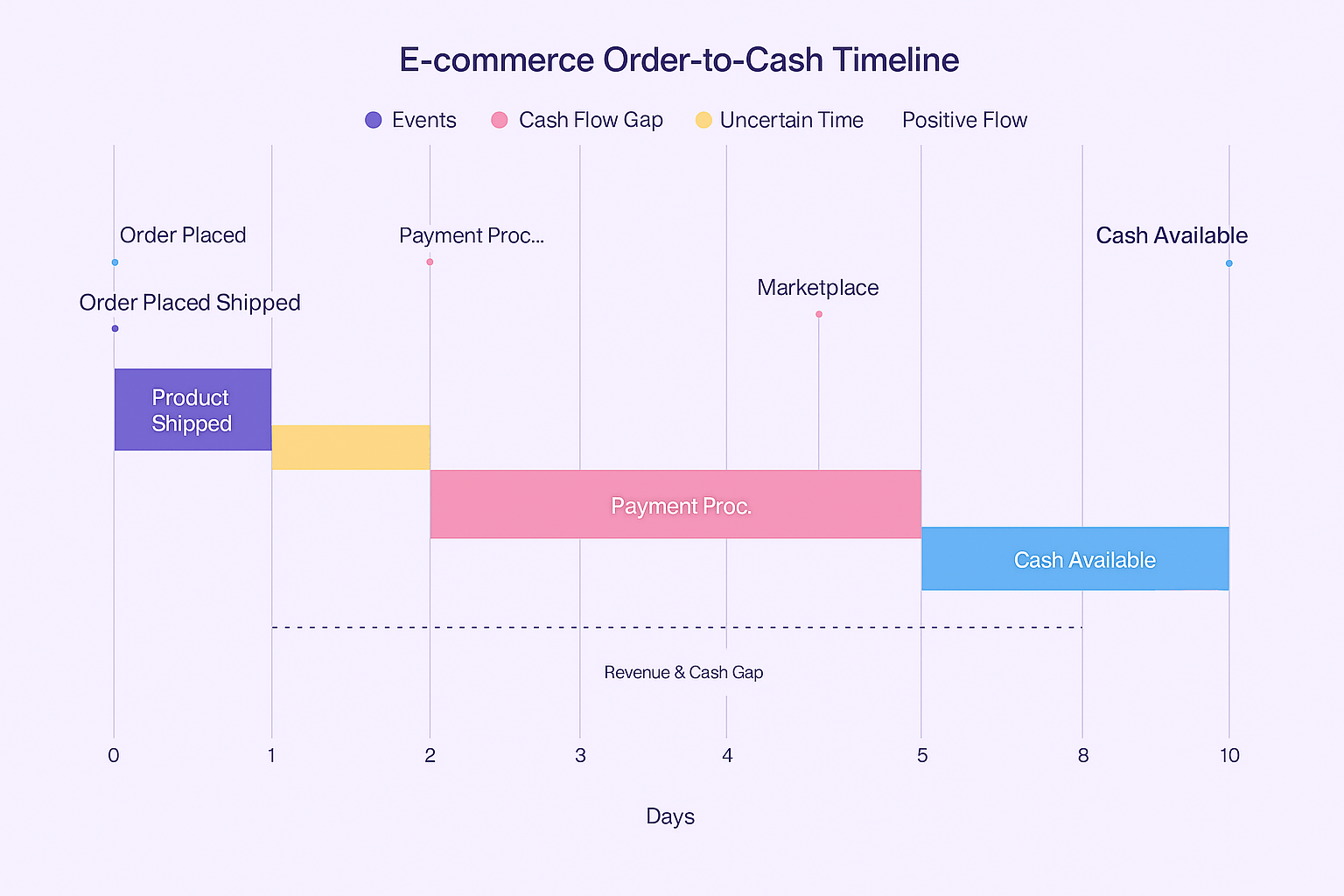

Why This Matters: The Cash Flow Crunch

That 3–14 day delay between order fulfillment and final cash receipt can kill growing businesses. More sales? Great. But more settlement lag + inventory purchases = cash flow stress.

Unless you’re forecasting cash flow with pinpoint precision, you’ll get caught in the classic e-commerce trap: “We’re selling more but still broke.”

If you’re scaling, timing is everything. Your ability to grow depends not just on sales but on how fast those sales turn into cash.

Marketplace-Specific Chaos (and How to Tame It)

Selling on Amazon sounds exciting… until you try to reconcile your books.

Marketplaces like Amazon, Etsy, Walmart, and eBay each bring their own flavor of complexity:

- Different fee structures

- Different payout timelines

- Different reporting formats

- Different return handling policies

This means your accounting team isn’t just managing one business they’re decoding the financial languages of multiple platforms… simultaneously.

Take Amazon, for example:

- It may hold funds for 14 days

- Deduct fees from every line item

- Adjust for returns post-settlement

- Send reports that look like hieroglyphics

If you’re not using integrated systems, you’ll spend days just finding the numbers let alone making decisions based on them.

| Aspect | Traditional Retail | E-commerce (Marketplace) | Accounting Challenge |

|---|---|---|---|

| Transactions/Day | 50–200 | 1,000–10,000+ | Massive volume needs automation |

| Payment Processing | POS, immediate | Multiple gateways, delayed | Complex fee reconciliation |

| Revenue Recognition | At sale | On shipment or delivery | ASC 606 timing rules |

| Inventory | Single store | Real-time, multi-channel | Risk of overselling |

| Fulfillment | Customer picks | Pick, pack, ship | Fulfillment cost tracking |

| Customer Interaction | Face-to-face | Only online | Refunds, disputes via systems |

| Payout Timeline | 0–1 days | 3–14 days | Cash flow unpredictability |

| Data Source | One POS | Many platforms | Fragmented, inconsistent formats |

| Tax Compliance | Local | Multi-country | Nexus, VAT, GST handling |

| Returns | In-store | Reverse logistics | Restocking, contra-revenue |

| Tech Needs | Basic | Highly integrated | Reconciliation automation |

| Cash Flow | Instant | Delayed | Advanced forecasting needed |

| Error Handling | Manual | Automated expected | Needs continuous sync |

| Channels | One | Many (Shopify, Amazon etc.) | Consolidated P&L issues |

How to Keep It Together (Without Losing Your Mind)

The key pain points for marketplace-based e-commerce businesses?

Data fragmentation: Shopify reports ≠ Amazon reports ≠ PayPal exports

Fee structures: Changing every few months, buried deep in settlements

Inventory sync: 3 sales channels, 1 warehouse, 0 room for mistakes

Cash flow planning: You’re rich on paper but broke until Stripe settles

To solve this, high-growth e-commerce businesses do three things:

1. Invest in automation tools (A2X, Link My Books, or custom Power Query flows)

2. Integrate all platforms into a central accounting hub (Xero, QuickBooks, or NetSuite)

3. Build customized dashboards for visibility across SKUs, channels, and cash flow cycles

Why This Matters for Growth

Mastering your Order-to-Cash process isn’t just a compliance task it’s your engine for scale.

If you don’t know:

When your money is arriving

What fees are eating into it

How returns impact revenue

Which channel is bleeding profits

Then you’re not in control of your business you’re just reacting.

Key Takeaways from Day 3

The Order-to-Cash Cycle in e-commerce spans 8 complex stages, each with its own accounting demands

Revenue ≠ Cash understanding timing gaps is crucial for managing working capital

Marketplaces complicate everything from fees to returns to reporting formats

You can’t grow without tech-enabled systems and automated reconciliation

Financial success starts with mastering your operations pipeline

We’re not ending with theory. Tomorrow, we’ll build the actual Chart of Accounts structure that every serious e-commerce business needs.

You’ll learn how to:

Track fees, returns, ad spend, and fulfillment costs

Separate Amazon from Shopify from your DTC store

Build a P&L that actually helps you make decisions

This will become the foundation of all future financial clarity.

Need Help Navigating This Maze?

If you’re running an eCommerce business and find yourself stuck in spreadsheets, confused about cash flow timing, or just tired of not knowing what’s really profitable let’s change that.

We specialize in eCommerce accounting, automation, and cash flow management. From reconciling multi-platform sales to setting up powerful dashboards we handle the backend so you can focus on scaling.

💬 Book a Free Consultation Today

Our team at Centflow Global will walk you through your financial blind spots and help design a system that gives you clarity and control.

📞 Call us (USA): +1 (559) 314-2899

🌐 Schedule a Call

Let’s make your numbers as scalable as your sales.