If you’re still manually entering every Amazon settlement, Shopify payout, or Stripe fee, you’re working way too hard—and probably losing sleep over mistakes and delays. Welcome to the era of end-to-end automation that literally does your books while you sleep.

Why Automation Is Your E-commerce Game-Changer

Modern e-commerce isn’t about a handful of sales anymore. Thousands of micro-transactions flow through your platforms daily. Doing this by hand wastes 15-25 hours every week and invites errors as high as 15%. Automation flips the script:

- 41% faster month-end closes

- 99%+ accuracy through AI anomaly detection

- Real-time dashboards that turn your cash flow from hindsight to insight

Think of it like having a super-smart autopilot for your finances—freeing you to focus on growth while your accounting runs flawlessly in the background.

The Core Building Blocks of Touch-Free Books

- Bank-Feed Automation

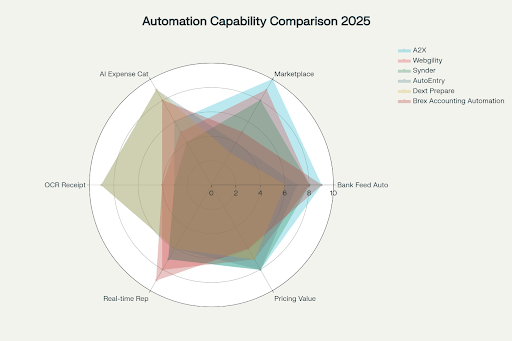

Connect directly to 14,000+ banks via open-banking APIs like Plaid and MX. Your accounting software pulls daily transactions automatically, matching them to the right accounts with security-first two-factor tokens keeping everything safe. - Marketplace & Gateway Sync

Tools like A2X and Webgility bridge your Amazon, Shopify, PayPal, and Stripe transactions straight into your books—sales, fees, shipping, and multi-currency splits sorted by order or daily summaries. - AI Expense Categorization

Machine learning sifts through merchant data to auto-assign general ledger codes with 95-99% precision, catching anomalies for human review. The smarter your AI gets, the fewer manual fixes you need. - OCR Receipt & Invoice Capture

Snap receipts on the go or auto-ingest supplier emails—tools like AutoEntry and Dext Prepare extract data with near-perfect accuracy, pushing clean expenses into your ledger without double-ups. - Automated Reconciliation

Auto-match deposits to invoices and marketplace journals with a single click, surfacing exceptions on dashboards for easy handling.

Getting Started: Your Automation Roadmap

- Activate bank feeds first—because nothing reconciles without cash flowing in daily.

- Use marketplace connectors tailored to your channels to dodge fee mapping headaches.

- Layer AI categorization on a clean chart of accounts; garbage in, garbage out still applies.

- Test in sandbox environments, then lock your rules before going live.

- Set a weekly routine to review exceptions—this isn’t a “set and forget” deal; humans still hold the steering wheel.