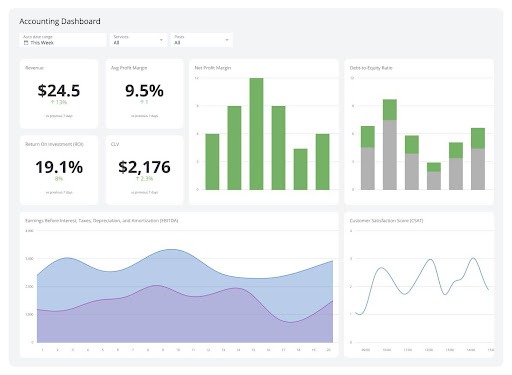

Welcome to our e-commerce accounting deep dive! We’ve covered fundamental concepts from financial foundations to revenue streams and expense management. Now, it’s time to address the burning questions we’ve received from real founders and e-commerce operators like you.

Your questions highlight the real challenges behind building a scalable, reliable financial system. Let’s tackle them one by one with clear, actionable guidance.

Q1: “I’m overwhelmed. If I’m still stuck managing everything manually on spreadsheets, where do I begin?”

Totally understandable! Transitioning from manual spreadsheets to a proper accounting system is a big leap. But here’s the secret: break it down into manageable phases.

Week 1-2: Lay Your Foundation

- Open a dedicated business bank account if you haven’t already. Mixing personal and business funds is a recipe for disaster.

- Pick a cloud-based accounting system designed for e-commerce, like QuickBooks Online or Xero.

- Link your bank for automatic transaction downloads.

Week 3-4: Automate Your Sales Channels

- Integrate your main sales platform (Shopify, Amazon, etc.) using specialized tools like A2X or Synder.

- Set up automation rules to reduce manual categorization.

Week 5-6: Set Processes

- Implement your customized chart of accounts (Day 4 guide is your friend here).

- Move to weekly bank reconciliations instead of monthly catch-ups.

Bottom line: Automation cuts errors by 90% and saves 40-60 hours monthly. Go step-by-step, don’t try to fix it all at once.

Q2: “Should I use cash or accrual accounting?”

Great question. It depends on your business scale and needs.

Choose Accrual if:

- Revenue is over $27 million annually (IRS rule).

- You hold inventory and want proper cost matching.

- You sell on marketplaces with delayed payments.

- You want accurate product/channel profitability.

- You’re aiming for external investment or loans.

Cash accounting might work if:

- You’re small (under $27 million revenue).

- You primarily dropship (no inventory).

- Your model has immediate payment and fulfillment.

- You prefer simple cash flow visibility.

For most e-commerce businesses managing inventory and complex payment cycles, accrual accounting gives the truest picture of financial health.

Q3: “I sell across Amazon, Shopify, and eBay how do I track profitability per channel?”

Multi-channel tracking is vital but can feel overwhelming without the right systems.

How to approach:

- Create separate revenue accounts per platform (e.g., Amazon Sales, Shopify Sales).

- Set up matching expense accounts for fees, ads, fulfillment by channel.

- Use integration tools: A2X for Amazon, native QuickBooks connectors for Shopify, Synder for eBay.

- Generate monthly profit reports by channel including CAC, returns, and margins.

Companies who track channels individually manage inventory 35% better and forecast cash flow 50% more accurately than those who don’t.

Q4: “What’s the difference between recognizing revenue at shipping vs. payment time? It’s confusing!”

This is a cornerstone of modern e-commerce accounting under ASC 606.

- When customers pay upfront, that cash is recorded as deferred revenue a liability until you deliver.

- When you ship the product, you recognize revenue and match cost of goods sold.

This prevents overstating revenue before fulfillment and ensures accurate profit tracking.

Example:

- Monday: Customer pays $100 → Cash +$100, Deferred Revenue +$100

- Thursday: Ship product → Deferred Revenue -$100, Sales Revenue +$100, COGS recorded.

This matching aligns your books with real business performance.

Q5: “Reconciling Amazon payments is a nightmare. Any better way?”

Amazon’s fee structures and settlements are notoriously complex.

- Settlement reports mix sales, fees, refunds, promotions across thousands of transactions.

- Manual reconciliation is error-prone and time-consuming.

Solution:

- Use A2X integration that imports and categorizes Amazon data into QuickBooks or Xero automatically.

- This tool parses fees and returns, mapping them to the right accounts.

- Costs $19-$79/month but saves 15-20 hours weekly for high-volume sellers.

Worth the investment to reduce errors and free your time.

Q6: “Returns and refunds mess up my books. How do I handle them properly?”

Returns are a huge headache but critical to manage correctly.

- E-commerce return rates average 18-30%, impacting revenue and inventory.

- Accounting treatment involves reversing the original sale in a contra-revenue account.

- Returnable inventory must be restocked (if salable) and COGS adjusted accordingly.

- Track shipping costs and decide who bears the return shipping.

- Build return reserves (typically 3-5%) based on historical return data to smooth income fluctuations.

Automation can help track return reasons and rates to optimize product listings and logistics.

Q7: “Do I hire a bookkeeper or an accountant? Can I DIY?”

Depends on your size and complexity.

- DIY if revenue <$10,000/month, simple operations, and you have 5-10 hours/week.

- Bookkeeper for $200-$600/month if revenue $10k-$100k, multi-channel complexity, limited time.

- Accountant for $400-$2,500/month if $100k+ revenue, international sales, or need financial planning.

Professional help reduces compliance risks by 50% and improves cash flow management by 30%.

Q8: “I’m expanding internationally. What extra accounting should I prep for?”

International growth adds many layers of complexity.

- You’ll need accounts for FX gains/losses, VAT, GST, import duties.

- Compliance with sales tax nexus rules in many states and countries.

- Documentation for transfer pricing, quarterly reporting, and tax registration.

- Software that handles multi-currency accounting and real-time tax calculations.

- Expect to add 15-20 extra accounts and budget $1,000-$10,000 annually for compliance support.

Planning early avoids costly mistakes.

Your E-commerce Accounting Implementation Roadmap

Next 7 days: Assess readiness, select software, open bank accounts.

Next 30 days: Build chart of accounts, integrate sales platforms, automate categorization.

Next 90 days: Set up channel profitability tracking, monthly reports, and train your team.

6-12 months: Plan for international accounting, hire professionals, implement advanced automation.