E-commerce businesses generate thousands of transactions every month, each with varying settlement times and fee structures. Manually managing this volume isn’t just inefficient — it’s virtually impossible to maintain accuracy at scale.

If your business processes more than 1,000 transactions monthly, automated integration is a must-have. Manual approaches typically lead to 15-25% error rates, which compound over time and erode your financial visibility.

The integration setup you put in place today will determine your ability to scale smoothly while keeping accurate, real-time insights for smart decision-making.

Platform-Specific Integration Strategies

Amazon Integration: Mastering Marketplace Complexity

Amazon’s settlement reports are notoriously complicated. Sellers must navigate FBA fees, referral fees, international transactions, and delayed settlements that span multiple accounting periods.

That’s where A2X shines. Built specifically for Amazon sellers, A2X transforms Amazon’s complex, cryptic settlement data into clean, organized accounting entries that match perfectly with bank deposits.

How A2X Works:

- Connect your Amazon Seller Central account

- Automatically fetch and categorize settlement data

- Handle multiple fee types including referral, FBA storage, advertising, and international fees

- Support multiple marketplaces and currencies

- Maintain detailed audit trails for compliance

A2X delivers 99% reconciliation accuracy, versus 60-70% with manual methods.

Cost-Benefit: Plans range from $29 to $99 per month, but businesses often save 15-20 hours per week. For Amazon sellers doing $100K+ monthly, ROI can be 3:1 within the first month.

For international sellers, A2X’s currency conversion and cross-border fee reconciliation are game changers, eliminating manual headaches and ensuring accuracy.

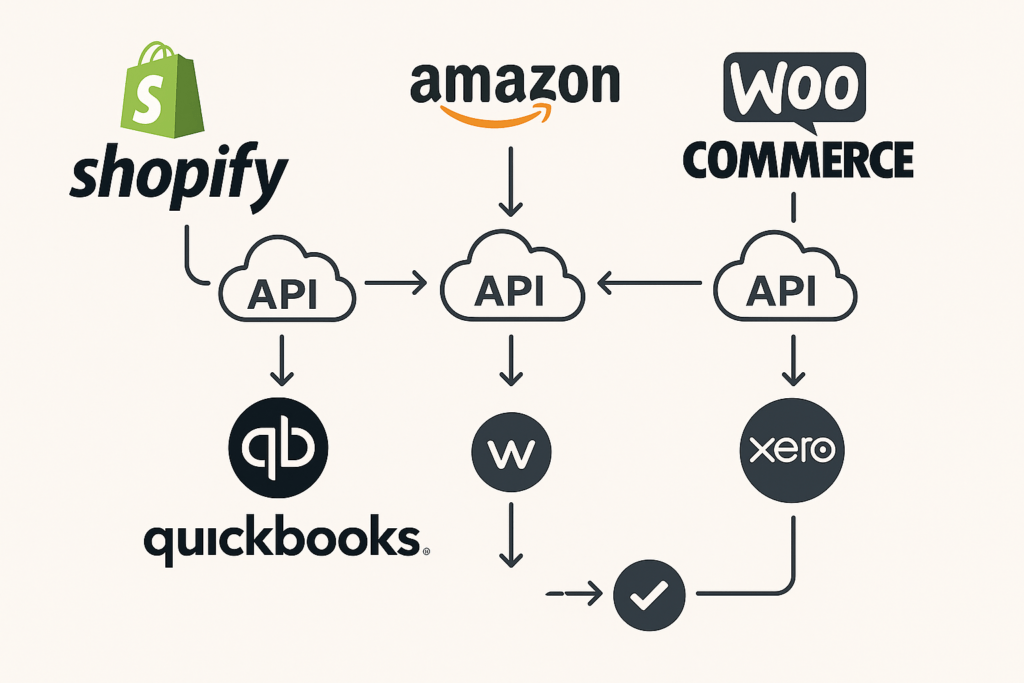

Shopify Integration: Native vs. Enhanced

Shopify’s native integrations with QuickBooks Online and Xero provide straightforward daily sales summaries, including taxes, discounts, fees, and payment method splits. They’re great for simple setups but may lack depth for complex businesses.

Native Shopify Integrations:

- QuickBooks Online syncs daily sales data, capturing fees and multi-payment methods.

- Xero offers similar features, with free usage in most regions (charges apply in some countries).

Enhanced Shopify Integration with A2X:

For businesses needing more detailed accounting, A2X offers:

- Precise transaction breakdowns

- Cost of goods sold (COGS) tracking

- Reconciliation aligned to bank deposits

This deeper insight is invaluable for businesses with multiple sales channels, complex inventories, or detailed profitability analysis needs.

WooCommerce Integration: Flexibility for WordPress Stores

WooCommerce users benefit from a range of integration options — from simple plugins to advanced third-party tools.

Plugin-Based WooCommerce Integrations:

- QuickBooks and Xero plugins that sync orders, payments, and customer data

- Popular options allow flexible, customizable syncing to suit business needs

Choosing the right integration requires careful consideration to avoid data mismatches and ensure accurate bookkeeping.

Here’s a rewritten, polished, SEO-optimized version of your content with clear structure and a natural flow, ready for a blog:

Advanced WooCommerce Integration and Implementation Strategy

WooCommerce Integration Plugins: The Basics

WooCommerce plugins typically offer order-level synchronization, inventory updates, and basic financial reporting. This plugin-based approach suits smaller businesses with straightforward workflows, providing an easy setup to connect WooCommerce with popular accounting platforms like QuickBooks or Xero. However, for growing or complex businesses, these basic plugins may lack the depth and automation needed to manage expanding transaction volumes and multi-channel operations.

Advanced Integration Solutions for WooCommerce

Larger WooCommerce operations benefit from specialized integration platforms such as Amaka, which offer robust features including:

- Unlimited transaction syncing

- Customizable invoice formatting

- Automated bank reconciliation matching

These advanced integrations support both granular order tracking and summarized reporting, giving businesses the flexibility to select the model that best fits their accounting and reporting requirements. As your business scales, this flexibility becomes critical for maintaining precise financial management and audit readiness.

Strategic Implementation Approach and Timeline

Phase 1: Planning and Assessment (1-2 Days)

Successful integration begins with thorough planning that aligns technical needs with your business objectives. Key activities include:

- Documenting current workflows

- Identifying data mapping needs

- Aligning with your chart of accounts

- Defining user roles and permissions

Neglecting this step often leads to costly integration failures and operational disruptions.

| Phase | Duration | Key Activities | Common Issues |

|---|---|---|---|

| Planning & Assessment | 1-2 days | System assessment, define requirements | Unclear scope, missing stakeholders |

| Software Selection | 2-3 days | Compare options based on needs | Feature gaps, budget overruns |

| Account Setup | 1 day | Configure accounts, basic software settings | Access errors, misconfiguration |

| Integration Install | 2-4 hours | Install and connect integration tools | Compatibility or permission issues |

| Data Mapping | 4-8 hours | Map transactions to accounts, setup rules | Chart mismatches, tax setup errors |

| Testing | 2-3 days | Verify data flow and accuracy | Data discrepancies, sync failures |

| Go-Live | 1 day | Launch live environment | User errors, production bugs |

| Optimization | Ongoing | Monitor, refine, and improve | Performance bottlenecks, scale issues |

Requirements Documentation

Document your integration needs in detail, including:

- Expected transaction volumes

- Reporting requirements

- Multi-currency handling

- Compliance needs

Factor in seasonal spikes, growth forecasts, and plans for adding new sales channels. Selecting scalable solutions upfront prevents future bottlenecks and cost overruns.

Phase 2: Tool Selection and Setup (2-4 Hours)

Choose integration tools based on your platform mix and accounting software. For combined Amazon and Shopify sellers, A2X is often the best fit, while pure Shopify sellers might start with native integrations.

Installation Tips:

- Follow provider setup guides carefully

- Ensure proper permissions (read sales data, write to accounting system)

- Prioritize security—these tools handle sensitive financial data

Phase 3: Data Mapping and Configuration (4-8 Hours)

Data mapping is the integration’s backbone—how platform transactions translate into accounting entries. Accurate mapping guarantees that data flows into the right accounts, aligned with your chart of accounts from Day 4.

Key considerations:

- Map sales, fees, refunds, and taxes to the correct accounts

- Handle marketplace fees and multi-currency transactions carefully

- Customize default mapping provided by tools like A2X for your business needs

- Document mapping decisions for team training and audit trails

Tax Configuration

Set up tax handling for all jurisdictions where you have sales tax responsibilities. Modern integrations can automate calculations, but precise configuration is vital for accuracy and compliance.

For international sellers, configure currency conversion and VAT/GST settings aligned with local laws—this often necessitates advanced features in tools like A2X.

Here’s a rewritten and polished version of your content for Phase 4: Testing and Validation, optimized for clarity and flow while retaining detail and length:

Phase 4: Testing and Validation (2-3 Days)

Why Testing Matters

Before going live, comprehensive testing is essential to ensure your integration accurately captures every transaction and reflects it properly in your accounting system. This phase catches issues early, preventing costly errors and reconciliation headaches down the line.

End-to-End Testing Process

Run test transactions that mirror your real sales workflow. This means simulating:

- Full and partial payments

- Refunds and returns

- Multi-currency transactions

- Fee adjustments and discounts

Verify that each transaction flows seamlessly from your e-commerce platform through the integration into your accounting software, and that reconciliations line up with your bank deposits perfectly.

Ensuring Data Accuracy

Cross-check integration results with manual calculations for a random sample of transactions. Confirm:

- Mathematical accuracy

- Correct account classifications

- Proper handling of fees and taxes

Document your test outcomes, including any issues and how they were resolved. This record will be invaluable for team training and ongoing system troubleshooting.

Common Integration Challenges & How to Solve Them

1. Data Format Inconsistencies

Each platform generates data differently—Amazon’s settlement reports are vastly different from Shopify’s transaction exports. This creates mapping challenges when integrating.

Solution: Use specialized tools like A2X, built to understand and translate platform-specific formats. Avoid generic integrations that might misinterpret complex data.

2. Real-Time Synchronization Failures

Network outages, API limits, or platform downtimes can disrupt real-time syncing, hurting your reporting accuracy.

Solution: Select integration tools with retry mechanisms, error handling, and queuing features. Monitor integration status proactively and set up alerts for failures.

3. Multi-Currency Complexities

Currency conversions cause timing mismatches, rounding issues, and reconciliation confusion. Manual management is time-consuming and error-prone.

Solution: Automate currency conversion with up-to-date rate feeds and use integrations that natively support multi-currency transactions.

Platform Integration Overview

| Platform | QuickBooks Integration | Xero Integration | Complexity Level | Setup Time | Monthly Cost | Best Tool | Key Features |

|---|---|---|---|---|---|---|---|

| Shopify | Native + A2X | Native + A2X | Medium | 2-4 hours | $0 – $99 | Native / A2X | Daily summaries, fee tracking |

| Amazon | A2X Required | A2X Required | High | 4-8 hours | $29 – $99 | A2X | Settlement reconciliation, FBA fees |

| WooCommerce | Plugin + A2X | Plugin + A2X | Medium | 3-6 hours | $0 – $79 | Amaka / A2X | Order sync, payment matching |

| eBay | A2X Required | A2X Required | High | 4-8 hours | $29 – $99 | A2X | Fee breakdown, return handling |

| Etsy | A2X Required | A2X Required | Medium | 2-4 hours | $29 – $99 | A2X | Transaction sync, fee tracking |

| BigCommerce | Native | Native | Low | 1-2 hours | $0 – $49 | Native | Real-time sync, order management |

Challenge 4: Navigating Fee Reconciliation Complexities

Marketplace fee structures are a moving target. They vary by transaction type, shift frequently, and often require complex calculations that many accounting systems aren’t equipped to handle. For example, Amazon alone charges over 20 different fee types that need precise categorization.

Solution: Rely on marketplace-specific integration tools that inherently understand these complex fee structures and can automatically categorize them correctly. Create separate expense accounts for each fee type to enable granular cost analysis and improved financial insight [see Day 6 Expense Management for reference].

Advanced Integration Optimization

Ongoing Performance Monitoring & Maintenance

As your transaction volumes grow, integration performance can degrade if not properly maintained. Establish continuous monitoring to ensure your system runs smoothly and scales with your business.

Key metrics to track:

- Synchronization speed

- Error rates

- Data accuracy

- System resource usage

Regular reviews help uncover bottlenecks and areas ripe for optimization before issues impact your accounting.

Automated Monitoring Setup

Set up real-time alerts to notify you immediately of:

- Integration failures

- Data mismatches

- Performance slowdowns

Dashboards that track integration health and performance trends provide vital visibility, empowering your team to resolve issues proactively and maintain smooth operations.

Planning for Scalability

Design your integration architecture with growth in mind. As your business adds sales channels, increases transaction volume, or expands internationally, your integration should seamlessly scale without becoming a bottleneck.

Consider future-proofing by:

- Allowing easy addition of new platforms

- Supporting increased automation levels

- Accommodating multi-currency and regulatory complexities

A scalable integration foundation protects your investment and sustains operational agility.

Measuring ROI and Success Metrics

Quantifying Integration Impact

Track your integration success by measuring:

- Time saved on manual tasks

- Reduction in reconciliation errors

- Speed of month-end close

- Quality and timeliness of financial reports

Well-executed integrations typically deliver a 3:1 ROI within 6–12 months through operational efficiency gains and improved financial control.

Calculating Time Savings

Before integration, measure the hours spent on manual data entry, reconciliation, and reporting. Post-integration, track how much time is freed up—most companies save 15–25 hours per week on these activities.

Translate these savings into cost benefits by calculating staff hourly rates and the opportunity cost of redirecting resources to strategic tasks.

Preparing for Day 10: Automation Unleashed

Tomorrow’s focus is “Setting Up Automated Data Entry and Bank Reconciliation,” which builds directly on your integration work today. The connections and mappings you’ve established will power automated workflows, streamlining bank feeds, expense categorization, and real-time financial reporting.

This automation stage will multiply your efficiency and the value of your integration investment.

Integration as Your Strategic Financial Foundation

Today’s integration phase lays the groundwork for all future accounting automation. Businesses investing in robust integration architecture position themselves to unlock advanced financial management capabilities and maintain control as they scale.

Your platform connections, data flow, and reconciliation rules are the backbone supporting the sophisticated frameworks we will explore throughout the series.