Building Systematic Workflows for Automated E-commerce Accounting Excellence

Following the detailed multi-channel data consolidation from Day 12, Day 13 focuses on creating the backbone that guarantees your automated bookkeeping runs smoothly, accurately, and scales effortlessly. Standard Operating Procedures (SOPs) turn automation tools from just helpful software into a solid, reliable business infrastructure. Today, we document workflows that ensure consistency, ease delegation, and provide the essential audit trails for compliance and long-term growth.

Why Traditional SOPs Don’t Work for E-commerce

E-commerce isn’t your typical retail business. Traditional accounting SOPs assume predictable, linear transaction flows—something e-commerce doesn’t have. Here’s why:

- Explosion in Transaction Volume: E-commerce businesses handle 10 to 100 times more transactions than traditional retailers.

- Real-Time Settlement Variations: Payment settlements can be instant (like UPI) or take up to 14 days (like Amazon), complicating cash flow management.

- Automation with Human Oversight: AI and automation manage routine tasks but require clear human review protocols that old SOPs don’t cover.

- Compliance Complexity: Multi-state sales tax, international transactions, and platform-specific rules need specialized workflows.

Research reveals that e-commerce businesses without well-documented SOPs face 40% higher error rates and take 60% longer to close their books monthly compared to those with automated, documented procedures.

Why You Need Systematic Documentation

Documented SOPs aren’t just “nice to have”—they’re critical for growth and control:

- Operational Consistency: Ensure the same outcome, every time, no matter who’s doing the task.

- Smooth Onboarding: New team members ramp up faster with clear, step-by-step workflows.

- Audit Readiness: Full documentation provides the compliance trail auditors and lenders demand.

- Process Improvement: SOPs expose bottlenecks and automation gaps you can fix.

- Risk Reduction: Segregate duties and approvals to prevent errors and fraud.

Phase 1: Designing Automated Workflow SOPs

Building the Backbone of E-commerce Bookkeeping

Creating effective SOPs for e-commerce bookkeeping means striking the perfect balance between automation and human oversight. Your workflows need to maximize efficiency without losing control.

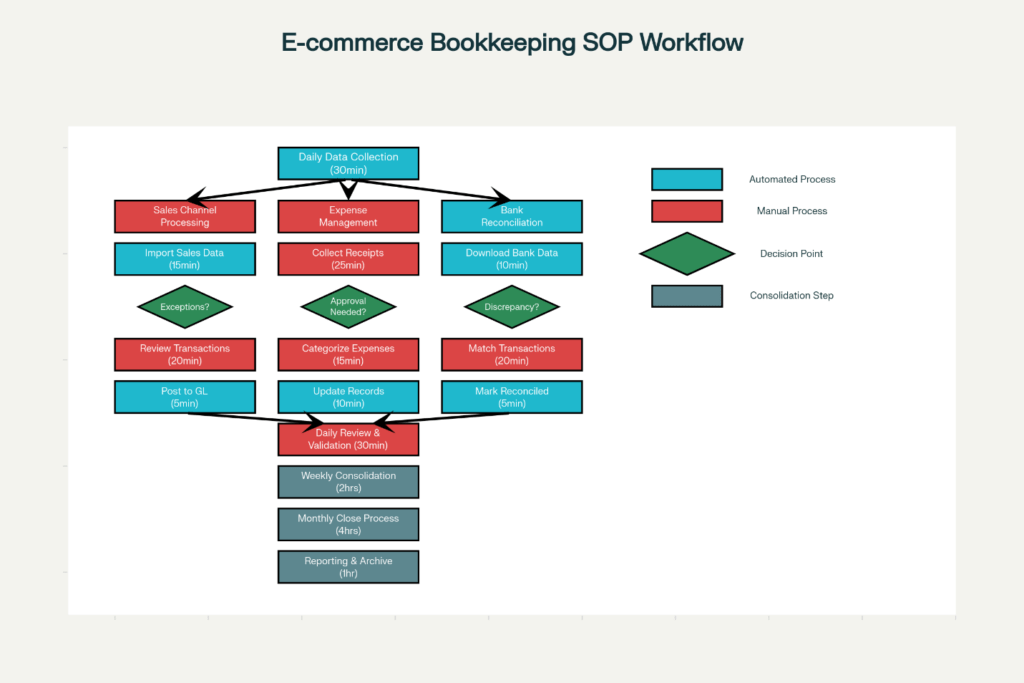

Here’s a four-tier operational framework that ensures your processes run smoothly and reliably:

Daily Operations (80-90% Automated)

- Importing transactions and automatically categorizing them

- Reconciling bank feeds with exception handling alerts

- Recognizing revenue across all your sales channels

- Monitoring cash flow in real time to keep your finger on the pulse

Weekly Procedures (60-80% Automated)

- Multi-channel reconciliation and verifying settlement accuracy

- Reviewing expense categorizations with approval workflows

- Processing inventory adjustments to keep stock data accurate

- Analyzing performance metrics and investigating any unusual variances

Monthly Close (40-70% Automated)

- Conducting comprehensive account reconciliations

- Preparing and reviewing financial statements

- Submitting compliance and regulatory reports

- Creating management reports with key analytics

Automation Integration Protocols

To get the most out of automation, your SOPs must clearly define the roles of technology versus human judgment:

- Automated Process Boundaries: Specify which tasks the system handles alone and where human approval is mandatory

- Exception Handling Procedures: Outline how to manage system alerts and unusual transactions effectively

- Override Protocols: Define when and how manual intervention is permitted in automated workflows

- Validation Requirements: Set rules for human review of automated categorizations and calculations to ensure accuracy

Phase 2: Internal Controls and Segregation of Duties

Securing Your E-commerce Bookkeeping with Smart Controls

E-commerce bookkeeping has unique risks and demands, so internal controls must be tailored for the digital environment—while keeping operations efficient.

Key Control Areas:

- Transaction Authorization: Multi-level approval processes depending on transaction size and type

- Data Access Controls: Role-based permissions that grant access only to authorized personnel

- Reconciliation Controls: Automated matching combined with manual review for exceptions

- Payment Processing Controls: Dual authorization steps for added security and verification

Implementing Segregation of Duties in Digital Workflows

Balancing security and efficiency requires smart use of technology:

- Role-Based Access Control: Systems enforce separation of duties through customized permissions

- Approval Workflows: Automated routing ensures transactions pass through the correct approval chain

- Audit Trail Maintenance: Every access and change is logged for transparency and accountability

- Compensating Controls: Backup procedures when perfect segregation isn’t feasible

| Process Step | Manual Task | Automated Alternative | Time Savings | Accuracy Improvement | Implementation Difficulty | Cost Range |

| 1. Data Collection | Export platform reports | API integration with auto-sync | 85% | 95% | Medium | $100-500/mo |

| 2. Initial Validation | Visual review of transactions | System validation rules | 70% | 90% | Low | $50-200/mo |

| 3. Categorization | Manual category assignment | AI-powered categorization | 90% | 85% | High | $200-800/mo |

| 4. Exception Handling | Research discrepancies | Automated exception alerts | 60% | 75% | Medium | $100-400/mo |

| 5. Reconciliation | Manual matching process | Auto-matching algorithms | 80% | 92% | High | $300-1000/mo |

| 6. Review & Approval | Manual review and sign-off | Workflow approval routing | 50% | 80% | Medium | $150-600/mo |

| 7. Reporting | Manual report generation | Automated report generation | 95% | 98% | Low | $50-300/mo |

| 8. Archive & Backup | Manual file organization | Cloud storage with versioning | 90% | 100% | Low | $20-100/mo |

Phase 3: Documentation Standards and Templates

Turning Procedures into Actionable Playbooks

Great SOPs aren’t just words on a page—they’re clear, standardized guides that anyone on your team can follow consistently, every time.

Here’s how to craft documentation that delivers clarity, consistency, and control:

Key Elements of Effective SOPs

- Objective Definition: Start with a crystal-clear statement explaining what the procedure aims to achieve—and why it matters.

- Scope and Applicability: Define exactly when and where this procedure applies to avoid confusion.

- Step-by-Step Instructions: Break down every action, highlight critical decision points, and include estimated time frames for each step.

- Control Points: Pinpoint moments where validation, approval, or specific documentation are mandatory to maintain quality.

- Exception Procedures: Provide clear instructions for handling unexpected or unusual scenarios so nothing falls through the cracks.

- Performance Metrics: Set measurable outcomes and quality benchmarks to track effectiveness and spot improvement opportunities.

Documenting Technology Integration

Automation is only as good as its documentation. Your SOPs need to demystify system interactions and define clear boundaries between tech and human tasks:

- System Access Procedures: Specify login processes, security requirements, and who gets what access level.

- Data Flow Mapping: Visualize how data moves between your sales platforms, accounting software, and other tools—and flag when humans need to step in.

- Error Handling Protocols: Detail systematic approaches for dealing with alerts, errors, or exceptions generated by your automation.

- Backup Procedures: Prepare manual workflows for when systems go offline for maintenance or unexpected failures, ensuring business continuity.

With these documentation standards in place, your SOPs evolve from vague guidelines into powerful, actionable tools that empower your team and safeguard your e-commerce financial operations.

| Close Day | Task | Responsible Role | Automation Status | Duration (Hours) | Dependencies |

| 1 | Download platform sales reports | Bookkeeper | Fully Automated | 0.5 | Platform access |

| 1 | Import bank transactions | Bookkeeper | Fully Automated | 0.25 | Bank feed setup |

| 2 | Reconcile payment gateways | Accountant | Semi-Automated | 2 | Gateway integration |

| 2 | Review automated categorizations | Senior Accountant | Automated with Review | 1 | AI categorization rules |

| 3 | Process inventory adjustments | Inventory Manager | Manual with System Support | 3 | Inventory system sync |

| 3 | Reconcile customer refunds | Customer Service Lead | Semi-Automated | 1.5 | Refund process workflow |

| 4 | Review and approve journal entries | Finance Manager | Manual | 2 | Approval hierarchy |

| 4 | Reconcile merchant accounts | Accountant | Semi-Automated | 1.5 | Merchant account access |

| 5 | Prepare accrual entries | Senior Accountant | Manual | 2 | Month-end cutoff |

| 5 | Review expense classifications | Finance Manager | Automated with Review | 1 | Expense approval workflow |

| 6 | Finalize balance sheet reconciliations | Senior Accountant | Semi-Automated | 4 | All reconciliations complete |

| 7 | Generate financial statements | Accountant | Fully Automated | 0.5 | Data accuracy verified |

| 8 | Management review and approval | CFO/Controller | Manual | 2 | All tasks complete |

| 9 | Prepare management reporting | Finance Manager | Automated with Review | 1 | Financial statements ready |

| 10 | Archive documents and close books | Bookkeeper | Automated | 0.25 | Management approval received |

Phase 4: Optimizing Your Monthly Close Process

Mastering the Art of Automated Month-End Closing

The month-end close is where all your accounting efforts come together — and it’s also the most demanding SOP of your bookkeeping cycle. It requires tight coordination between automated workflows and human insight.

Key Stages of the Monthly Close

Pre-Close Preparation (Days 25-30):

- Auto-calculate and post accruals

- Update and adjust inventory valuations

- Allocate expenses across departments

- Perform initial variance analysis and flag anomalies

Core Close Activities (Days 1-5):

- Complete and approve bank reconciliations

- Validate revenue recognition from every sales channel

- Reconcile accounts with supporting documentation

- Prepare financial statements and submit for management review

Post-Close Actions (Days 6-10):

- Generate management reports and analytics

- File necessary compliance and regulatory documents

- Analyze performance and identify process improvements

Automate vs. Manual — A Clear Decision Framework

Standard operating procedures must spell out what tasks automation can handle independently, what needs human review, and which require manual execution:

| Automation Level | Tasks Included |

|---|---|

| Fully Automated | Routine reconciliations, report generation, recurring journal entries |

| Semi-Automated | Automated calculations requiring manual review or approval |

| Manual Required | Complex judgements, exceptions, and final approvals |

SOP Task Breakdown: Frequency, Time, Priority & Controls

| SOP Category | Procedure | Frequency | Time (hrs) | Priority | Automation % | Key Controls |

|---|---|---|---|---|---|---|

| Daily Operations | Transaction Import & Review | Daily | 0.5 | Critical | 80% | Dual approval, system checks |

| Daily Operations | Bank Feed Reconciliation | Daily | 0.75 | Critical | 90% | Auto-match, exception alerts |

| Daily Operations | Exception Handling | Daily | 0.33 | High | 40% | Supervisor review, docs |

| Daily Operations | Revenue Recognition | Daily | 0.25 | Critical | 70% | Platform sync validation |

| Weekly Procedures | Multi-Channel Reconciliation | Weekly | 2 | Critical | 60% | Cross-platform validation |

| Weekly Procedures | Expense Categorization Review | Weekly | 1 | High | 50% | AI review, approval workflow |

| Weekly Procedures | Inventory Adjustment | Weekly | 0.75 | Medium | 30% | Physical count verification |

| Weekly Procedures | Cash Flow Analysis | Weekly | 0.5 | High | 85% | Automated forecasting |

| Monthly Close | Account Reconciliation | Monthly | 4 | Critical | 70% | Bank confirmations, docs |

| Monthly Close | Financial Statement Prep | Monthly | 6 | Critical | 40% | Review & approval |

| Monthly Close | Variance Analysis | Monthly | 2 | High | 60% | Automated variance flags |

| Monthly Close | Compliance Reporting | Monthly | 3 | Critical | 75% | Regulatory checklist |

| Quarterly Reviews | Internal Controls Testing | Quarterly | 8 | High | 20% | Sample testing, doc review |

| Quarterly Reviews | Process Optimization Review | Quarterly | 4 | Medium | 30% | KPI dashboards |

| Annual Procedures | Audit Preparation | Annual | 20 | Critical | 10% | External auditor liaison |

| Annual Procedures | Chart of Accounts Update | Annual | 6 | Medium | 20% | Approval workflows |

Phase 5: Performance Monitoring & Continuous Improvement

Turning SOPs into Growth Engines

To ensure your SOPs deliver real value, continuous measurement and iteration are crucial. This isn’t a “set and forget” job — your processes must evolve with your business.

Key SOP Performance Metrics:

- Efficiency: Time to complete tasks, automation success rate, resource utilization, cost per transaction

- Quality: Error rates, rework frequency, compliance adherence, audit findings

- User Adoption: SOP compliance, training effectiveness, user feedback

Continuous Improvement Practices:

- Quarterly SOP reviews to assess effectiveness

- Updating procedures to leverage new automation tools

- Adapting to regulatory changes promptly

- Scaling processes to handle new sales channels and volumes

Phase 6: Implementation and Change Management

Rolling Out SOPs for Seamless E-commerce Bookkeeping

Implementing your Standard Operating Procedures (SOPs) is more than flipping a switch — it demands a strategic rollout and change management plan that ensures your team adopts new workflows smoothly and confidently.

SOP Rollout Strategy: From Pilot to Full Launch

- Pilot Implementation: Start small by testing SOPs within a limited scope to identify gaps before full-scale deployment.

- Training & Documentation: Provide comprehensive training sessions and clear reference materials so users understand procedures thoroughly.

- Parallel Operation: Run the new SOPs alongside existing processes during the transition to minimize disruption.

- Performance Monitoring: Track adoption metrics and gather feedback to confirm SOP effectiveness and user compliance.

Managing Resistance and Adoption

Change isn’t always easy. To overcome natural resistance, deploy these best practices:

- Clear Communication: Explain the benefits and necessity of SOPs upfront to build buy-in.

- Stakeholder Inclusion: Engage key users early to tailor SOPs and increase ownership.

- Incremental Rollout: Gradually implement SOPs to reduce operational shock.

- Support Systems: Maintain ongoing assistance channels and feedback loops.

Role-Based Responsibilities and Controls

| Function | Initiator | Reviewer | Approver | System Access | Documentation | Critical Controls |

|---|---|---|---|---|---|---|

| Order Processing | Sales Team | Order Fulfillment | Finance Team | Accounting Software | Sales Reports | Multi-channel sync verification |

| Expense Approval | Department Manager | Finance Manager | CFO/Controller | Expense System | Expense Receipts | Budget approval, receipt validation |

| Payment Authorization | Finance Manager | CFO/Controller | CFO | Banking Platform | Payment Authorization | Dual authorization, dollar limits |

| Bank Reconciliation | Accountant | Finance Manager | CFO/Controller | Bank Feeds + Accounting | Bank Statements | Auto-matching, exception handling |

| Inventory Management | Warehouse Manager | Finance Team | CFO/Controller | Inventory + Accounting | Stock Reports | Physical count, system sync |

| Financial Reporting | Senior Accountant | Finance Manager | CFO | Financial Systems | Financial Statements | Review hierarchy, approval workflow |

| System Administration | IT Administrator | Finance Manager | CFO | All Systems | System Logs | Access controls, change management |

| Customer Refunds | Customer Service | Supervisor | Finance Manager | CRM + Accounting | Refund Requests | Authorization limits, customer verification |

| Vendor Payments | Accounts Payable | Finance Manager | CFO/Controller | AP Module | Invoices + PO | Three-way matching, approval limits |

| Tax Compliance | Tax Specialist | External Consultant | CFO | Tax Software | Tax Returns | Compliance checklist, external review |

| Audit Coordination | Finance Director | External Auditor | Board/Audit Committee | All Financial Systems | Audit Reports | Independence, professional standards |

Technology Integration for SOP Management

Successful SOP management today leverages dedicated technology platforms that support dynamic documentation and workflow automation:

- Document Management: Centralized repositories with version control and permission management.

- Workflow Automation: Integration with accounting systems and approval routing for seamless operations.

- Training Platforms: Tools to onboard users efficiently and provide ongoing education.

- Performance Analytics: Dashboards to track SOP adherence and optimize processes continuously.

Integration with your existing accounting infrastructure is key:

- Compatible with QuickBooks, Xero, NetSuite, and others.

- Syncs multi-channel sales data from Shopify, Amazon, eBay, and more.

- Utilizes bank feeds and automated reconciliation workflows established earlier.

- Supports real-time reporting and KPI dashboards for management insight.

Embedding Compliance and Audit Readiness

SOPs are your frontline defense in maintaining regulatory compliance:

- Tax Workflows: Automate sales tax calculations and filings per jurisdiction.

- Financial Standards: Ensure GAAP-compliant revenue recognition and expense matching.

- Industry-Specific Rules: Adapt SOPs for platform requirements and cross-border trade.

- Audit Trails: Build comprehensive documentation and logs directly into workflows — no retroactive patching.