(And why tracking them isn’t optional anymore)

By now, we’ve laid a strong foundation from understanding the chaos of the order-to-cash cycle to designing a chart of accounts built for speed, accuracy, and scale.

Today, we move from structure to flow.

Because in modern e-commerce, revenue doesn’t just come in through the front door.

It seeps, streams, and sometimes crashes in from ten different directions each with its own quirks, rules, and pitfalls.

E-commerce Isn’t Just About Selling Products Anymore

Gone are the days of one-and-done transactions.

Today’s top e-commerce businesses pull in revenue from a complex, multi-channel ecosystem:

- Subscriptions with delayed recognition rules

- Affiliate earnings tied to external payouts

- Digital downloads with global tax implications

- Bundled services that span delivery timelines

Each revenue type impacts your books differently and if your chart of accounts doesn’t reflect this, you’re not just leaving money on the table…

You’re inviting confusion into your cash flow.

Why This Matters:

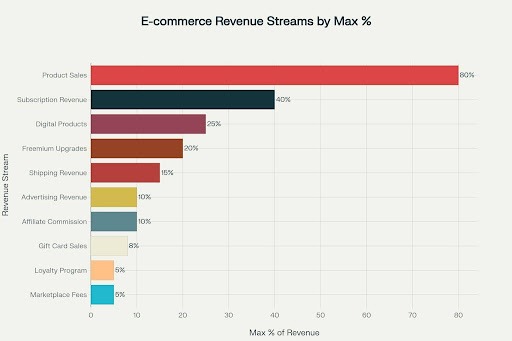

Product sales still dominate, contributing 60–80% of revenue in most e-commerce businesses.

But the businesses that scale profitably don’t stop there. They diversify and so do their accounting challenges.

A one-size-fits-all revenue category might look clean on the surface.

But underneath, it hides mismatched recognition timing, flawed tax tracking, and faulty profitability analysis.

Today’s post breaks down 10 essential e-commerce revenue streams and shows how to map each to your chart of accounts the right way.

How Each E-commerce Revenue Stream Behaves in Your Books

Yesterday, we framed your chart of accounts as the command center for financial clarity.

Today, we plug in the actual cash flows and trust us, not all revenue is created equal.

Some streams are smooth and predictable.

Others? They’re moody, delayed, and full of traps.

Here’s how to handle them cleanly, confidently, and without getting your numbers tangled.

1. Product Sales – Your Day-One Revenue Engine

This is where it all started for most founders:

Someone clicks “Buy,” and boom money hits the account.

But behind that dopamine hit is a timing dance that can derail your books if done wrong.

Under ASC 606, revenue is recognized when control transfers not at order, not at delivery, but often when the item is shipped.

Good practice: Record as deferred revenue at order placement

Then recognize it when shipping happens

Common miss: Not accounting for returns (~3–5% reserve)Tip: Integrate shipping data directly into your accounting software. If you’re still relying on manual entry or daily exports, your books are already off by a day.

2. Subscriptions – The Predictable but Tricky Stream

Subscription revenue is a dream for forecasting but a nightmare if you recognize it all upfront.

Let’s say a customer pays you $1,200 today for a 12-month plan.

You want to log the whole thing.

But under ASC 606, you can only recognize $100/month matching your service delivery.

Smart move: Build automated deferred revenue schedules

Big challenge: Mid-month upgrades, churn, and refunds

Tip: Use systems that track performance obligations not just payments. That’s what keeps your books tight and your auditors calm.

3. Digital Products Instant Delivery, Instant Chaos

Sell a PDF? A video course? A license key?

Your customer gets access the moment they buy and that’s your cue to recognize revenue.

Simple, right?

Until you add:

- Bundle pricing (PDF + Course + Support)

- Time-limited access

- Global tax laws for digital goods

Rule of thumb: Recognize revenue the moment access is granted

Don’t forget: Some licenses require pro-rata allocation

Tip: Integrate your content delivery platform with your accounting tool to automatically timestamp control transfer.

4. Affiliate Commissions – The Lagging Performer

Affiliate income feels like free money until you try to track it.

Why?

Because there’s usually a lag between conversion and payout.

Example:

- A sale happens via your link today

- The brand confirms it in 7 days

- You receive the payout 30 days later

You recognize revenue only after the sale is confirmed

Don’t book based on estimated commissions you’ll be off every time

Tip: Build a confirmation pipeline before logging revenue even if you’re using platforms like Impact or ShareASale.

Affiliate Revenue – Not All That Glitters is Cleared to Recognize

On paper, affiliate revenue feels like a win-win:

Someone else drives the traffic, you get the sale, everyone earns.

But behind the scenes?

It’s a jungle of delayed payouts, tracking disputes, and attribution headaches.

Here’s what makes affiliate income messy:

- Sales confirmation delays

Just because a click happened doesn’t mean a commission is earned. The sale has to clear. Refund windows must pass. - Attribution battles

Ever had two platforms claim credit for one sale? It’s like having two people fighting over the same commission check. - Inconsistent payment terms

Some pay in 30 days. Some in 90. Some… never.

ASC 606 says: You can only recognize revenue when the sale is confirmed and the commission is legally collectible.

Best Practices (to stay sane):

- Automate with API-powered tools

Use affiliate platforms that sync data in real-time with your accounting tool so you’re not updating Excel sheets at midnight. - Log the terms

Keep a centralized record of all partner agreements: commission rates, payout terms, return windows. If it’s not written down, it’s a liability. - Plan for timing gaps

There’s often a 30–60 day delay between when the sale happens and when money actually arrives. Your cash flow forecast should reflect that.

| Revenue Stream | Initial Journal Entry | Revenue Recognition Entry | Key Timing Factor | Common Complications | Required Estimates |

| Product Sales | Dr. A/R $1,000 | Cr. Deferred Revenue $1,000 | Dr. Deferred Revenue $1,000 | Cr. Product Sales Revenue $1,000 | Shipping date | Returns, defective products, shipping delays | Return reserves (3-5% of sales) |

| Subscription Revenue | Dr. Cash $1,200 | Cr. Deferred Revenue $1,200 | Dr. Deferred Revenue $100 | Cr. Subscription Revenue $100 (monthly) | Service delivery period | Mid-period cancellations, upgrades/downgrades | Churn rates, refund probabilities |

| Affiliate Commission | Dr. Commission Receivable $200 | Cr. Affiliate Revenue $200 | Recognition occurs when earned | Confirmation of referred sale | Return periods, commission disputes | Collection rates, dispute reserves |

| Digital Products | Dr. Cash $50 | Cr. Digital Sales Revenue $50 | Immediate recognition upon access | Download/access availability | Licensing terms, access restrictions | Minimal – immediate recognition |

| Gift Cards | Dr. Cash $100 | Cr. Gift Card Liability $100 | Dr. Gift Card Liability $100 | Cr. Revenue $100 (upon redemption) | Customer redemption | Breakage analysis, escheatment laws | Breakage rates (15-20%), redemption patterns |

| Shipping Revenue | Dr. A/R $15 | Cr. Deferred Shipping Revenue $15 | Dr. Deferred Shipping Revenue $15 | Cr. Shipping Revenue $15 | Package shipment | Lost packages, delivery failures | Delivery failure rates |

| Freemium Upgrades | Dr. Cash $29 | Cr. Premium Service Revenue $29 | Recognition over service period if ongoing | Premium service activation | Feature bundling, upgrade timing | Service delivery patterns |

| Advertising Revenue | Dr. A/R $500 | Cr. Deferred Ad Revenue $500 | Dr. Deferred Ad Revenue $X | Cr. Ad Revenue $X (as ads display) | Ad impression delivery | Click fraud, impression disputes | Delivery rates, dispute adjustments |

Gift Cards – The Liability You’re Probably Misreporting

When someone buys a gift card from your store, here’s what doesn’t happen:

You don’t make revenue.

Instead, you’ve just taken on a contractual obligation. That gift card is a ticking financial promise not a payday.

Under ASC 606, every gift card sold creates deferred revenue until one of two things happens:

- It gets redeemed (yay, real sale!)

- It never gets used (aka breakage)

But wait… what about breakage?

Most e-commerce brands will see 15–20% of gift card balances go unredeemed.

That unspent cash? That’s recognized as breakage income slowly, over time, and only proportionally to other fulfilled obligations.

Translation:

You can’t just scoop up unused gift card cash after 12 months and call it profit.

What complicates this:

- Escheatment laws

Some states want that unredeemed money. Yes, seriously. You might be required to hand it over to the state. - Audit nightmares

Estimating breakage without clear historical data is like guessing taxes with dice.

Freemium Isn’t “Free” It’s an Accounting Puzzle

Freemium models are seductive.

Give away the basics. Upsell the premium. Watch the upgrades roll in.

But here’s the part no one talks about:

The accounting behind freemium is a tangled web of performance obligations.

What makes it tricky?

When a customer upgrades to premium:

- Is that a one-time unlock?

- Or a monthly service with ongoing delivery?

Under ASC 606, you can’t just dump that revenue into your books on Day 1.

You need to:

- Separate free vs paid components

- Ask if the free part has real standalone value

- Spread revenue across time if it’s a service, not a product

What you need:

- A system to track when features are actually delivered

- Clear documentation of what your free and paid plans include

- Revenue schedules based on service fulfillment — not customer payments

Freemium is great for growth. But if you’re not recognizing revenue right, it’s a growth illusion.

Selling Internationally? Say Hello to FX, VAT, and 15 New Accounts

The dream: Global sales across continents.

The reality: Currency headaches, tax labyrinths, and accounting chaos.

What complicates global revenue:

- Different tax laws in every region (VAT in Europe, GST in Australia, etc.)

- FX rate changes that impact profit margins overnight

- Payment delays and compliance rules that vary wildly

And here’s the kicker:

You need to recognize revenue at the right time in your home currency even when the customer pays in yen, rupees, or euros.

Best practices:

- Use daily FX rate feeds to revalue balances accurately

- Track FX gains/losses monthly don’t bury them in COGS

- Maintain separate tax accounts by country for VAT/GST

- Ensure your accounting tools support multi-currency reporting

Pro Tip: Global e-commerce requires 15–20 more accounts than domestic-only businesses just to stay compliant.

| Revenue Stream | Primary Challenge | ASC 606 Requirement | Practical Solution | Common Mistake | Best Practice |

| Product Sales | Revenue recognition timing with shipping delays | Recognize when control transfers (typically shipping) | Integrate shipping systems with accounting software | Recognizing revenue at order placement | Automate shipping date capture from fulfillment systems |

| Subscription Revenue | Allocating annual payments over service period | Recognize revenue as performance obligations satisfied | Use subscription management software with rev rec automation | Recognizing full payment upfront | Monthly revenue allocation based on service delivery |

| Marketplace Sales | Agent vs Principal determination | Analyze who controls goods before transfer to customer | Document control indicators and decision rationale | Recording gross instead of net revenue | Regular review of marketplace agreements and control factors |

| Digital Products | Determining exact moment of control transfer | Control transfers when customer can use and benefit | Automate revenue recognition upon download/access | Delayed recognition pending customer confirmation | Real-time integration between sales and delivery systems |

| Gift Cards | Estimating breakage rates for unredeemed cards | Recognize breakage proportionally to redemption pattern | Analyze historical redemption data and trends | Waiting too long to recognize breakage revenue | Quarterly breakage analysis with documented methodology |

| Affiliate Commission | Tracking commission accuracy across partners | Recognize when commission is earned and collectible | Implement affiliate tracking software with API integration | Recognizing commissions before sale confirmation | Automated commission tracking with dispute resolution process |

| International Sales | Multi-currency and tax compliance complexity | Apply consistent recognition regardless of currency | Use multi-currency accounting system with tax automation | Inconsistent currency conversion timing | Daily currency rate updates with hedge accounting if applicable |

| Shipping Revenue | Separating shipping from product performance obligations | Evaluate if shipping is distinct performance obligation | Analyze shipping service independence from product | Bundling shipping with product revenue inappropriately | Document shipping service analysis and allocation methodology |

Implementation Challenges & Strategic Fixes

Tech Integration: Where Most Founders Fumble

Running multiple revenue streams without tight integration is like trying to DJ five songs at once with no mixer.

You’ve got:

- Amazon → Shopify → Stripe

- Subscriptions → Gift Cards → Affiliates

- And a single finance team trying to make sense of it all

That’s chaos.

What you need is automation + orchestration.

What Good Tech Fixes:

90% fewer data errors

40–60 hours/month saved in manual work

Real-time reporting from all sales channels

But here’s the trick:

Integration isn’t a one-tool job. You need:

- Platform connectors

- Accounting sync

- Custom rules per revenue stream

- A joint mission between accounting + tech

💡 Pro Tip: Don’t treat tech as an afterthought.

Treat it like a business partner that prevents future audits from turning into horror stories.

🧾 Revenue Recognition Isn’t Optional It’s a System

Every revenue stream—subscriptions, gift cards, affiliates has its own rhythm.

ASC 606 demands you follow it. Exactly.

To stay compliant, here’s what you need:

- 🔁 Automated revenue recognition workflows (no more Excel hacks)

- 🚨 Exception reports for weird transactions

- 📄 Clear documentation for each stream’s policy

- 👨🏫 Staff trained on what “earned revenue” actually means

Think of it this way:

Revenue recognition is like gravity in accounting.

You can ignore it but it won’t ignore you.

Build it right the first time.

Or pay for the mess in your next audit.

| Revenue Stream | Revenue Recognition Point | Account Classification | Key Characteristics | ASC 606 Considerations | Typical % of Total Revenue |

| Product Sales | When shipped to customer | Product Sales Revenue (400100-400199) | One-time transaction, immediate fulfillment | Control transfers at shipping point | 60-80% |

| Subscription Revenue | Over subscription period | Subscription Revenue (400200-400299) | Recurring monthly/annual payments | Deferred revenue, recognize over time | 10-40% |

| Shipping Revenue | When product is shipped | Shipping Revenue (400300) | Charges for delivery services | Separate performance obligation | 5-15% |

| Affiliate Commission | When referred sale is confirmed | Affiliate Revenue (400400) | Commission from promoting others’ products | Recognize when earned and collectible | 2-10% |

| Digital Products | Upon download/access grant | Digital Sales Revenue (400500) | Instant fulfillment, no inventory | Control transfers immediately | 5-25% |

| Marketplace Fees | When service is provided | Platform Fee Revenue (400600) | Fees from sellers using platform | Agent vs principal determination | 1-5% |

| Gift Card Sales | When redeemed or breakage occurs | Deferred Revenue (Liability) | Prepayment for future goods/services | Contract liability until redeemed | 3-8% |

| Advertising Revenue | When ads are displayed | Advertising Revenue (400700) | Revenue from ad placements | Performance obligation satisfied over time | 1-10% |

| Freemium Upgrades | When premium service starts | Premium Service Revenue (400800) | Free basic + paid premium features | May require bundling analysis | 5-20% |

| Loyalty Program | When points are redeemed | Deferred Revenue (Liability) | Points/rewards for purchases | Allocate transaction price to points | 2-5% |

Building Financial Intelligence Through Revenue Stream Analysis

You’re not just tracking money.

You’re decoding how your business makes it, where it flows best, and what’s quietly draining it.

When done right, revenue stream accounting unlocks:

- Strategic growth decisions

- Smarter cash flow forecasting

- Sharper marketing and ops targeting

But here’s the catch:

Different streams need different KPIs.

- Subscriptions? → Lifetime value, churn

- Product sales? → AOV, conversion rate

- Affiliates? → Attribution, payout delay risk

When you plug revenue stream data into your bigger financial machine inventory, CAC, ops you don’t just get reports.

You get clarity.

🧭 Preparing for Operational Excellence

Mastering multi-stream revenue isn’t just about compliance.

It’s your entry ticket to scale with sanity.

It sets the stage for what’s next:

Expense intelligence, cost slicing, and scaling smartly without financial blind spots.

👀 What’s Next: Expense Management Mastery

On Day 6, we break down every rupee you spend:

- COGS

- Fulfillment

- Marketing

- Returns

… and where your money should go instead.