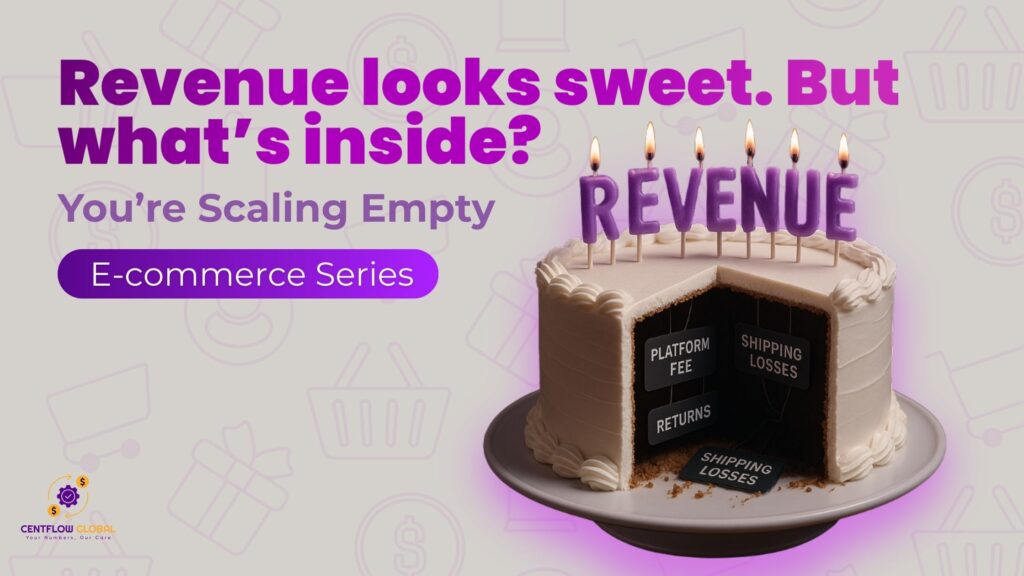

Let’s face it running an eCommerce business means your finances are spread everywhere.

Sales on Amazon. Returns from Shopify. Fees from Stripe. Tax from three states.

By the time it hits your books, it’s chaos.

Today, we fix that.

Your Chart of Accounts (COA) is the backbone of your entire financial system. It’s how you name, sort, and track every rupee (or dollar) that flows in and out of your business across platforms, marketplaces, and payment processors.

But here’s the twist:

Unlike brick-and-mortar stores, eCommerce isn’t just “Sales,” “COGS,” and “Expenses.”

You need a structure that can actually handle:

- Marketplace fees (Amazon, Etsy, Walmart… each with its own cut)

- Payment processor deductions (Stripe, PayPal, AfterPay)

- Platform-specific shipping costs

- Inventory tracking across fulfillment centers and dropshippers

- Tax obligations for every jurisdiction you ship to

A standard COA won’t cut it.

You need one that’s built for digital chaos but delivers financial clarity.

If you’re selling on Amazon, Shopify, eBay, Etsy, Walmart or all of them at once you already know:

⚠️ The real mess doesn’t start when you sell the product.

It starts after when money flows in late, split, and trimmed by fees you didn’t see coming.

Think Back to the Order-to-Cash Cycle

Remember that 8-stage journey we unpacked yesterday?

From the moment a customer hits “Buy Now”…

…to the moment you actually see the money…

Each step creates its own accounting footprint:

- Marketplace fees

- Shipping deductions

- Payment processor holds

- Taxes across states

- Return reserves

- And a dozen other tiny “leaks”

If your chart of accounts isn’t structured to capture each of these touchpoints you’re flying blind.

The Data Is Clear

- 67% of eCom businesses with a tailored chart of accounts close books 40% faster

- They get 25% better profitability insights than those stuck with a generic setup

The Multi-Channel Trap: Why Most Founders Miss It

Amazon takes 15–20% right off the top.

Shopify charges you for the store and the gateway.

eBay has its own fee tiers.

Walmart settles late.

Stripe holds cash.

If your chart of accounts just says “Sales” and “Fees”…

You’re missing the full story.

With a custom chart built for multi-channel selling, you can:

- Spot which platform is actually profitable

- Fix cash flow issues before they become tax season headaches

- Compare ad spend vs. ROI channel by channel

One study showed businesses with platform-specific account structures had:

- 35% better inventory management

- 50% more accurate cash flow forecasting

E-commerce Chart of Accounts: The Structure That Actually Works for You

Forget cookie-cutter accounting templates.

If you’re running an e-commerce brand especially one selling across Amazon, Shopify, Etsy, eBay, or internationally your chart of accounts isn’t just a spreadsheet.

It’s a strategic weapon for:

- Channel-level profitability

- Cash flow clarity

- Fee leak detection

- Smarter growth decisions

Let’s break down how the right structure helps you stay in control even when your sales are split across five platforms and twelve currencies.

The Foundation: 6-Digit, Scalable, and Built for Growth

E-commerce accounting works best with a 6-digit numbering system. Why?

Because it lets you go deep (SKU-level if needed) without losing your way. Here’s the backbone:

Assets (100000–199999)

- Separate bank accounts from marketplace settlements (Amazon payouts ≠ cash in hand)

- Track inventory reserves, clearing accounts, and PayPal balances independently

Liabilities (200000–299999)

- Tag taxes by state/country (hello, nexus)

- Include deferred revenue (like pre-orders or subscription sales)

- Track payment processor payables (Stripe/Shopify holds)

Equity (300000–399999)

- Standard shareholder equity and retained earnings

- Add new lines for VC capital, SAFE notes, or partner splits if you’ve raised money

Revenue (400000–499999)

This is where most brands mess up. Don’t lump all sales into “Revenue.”

Break it by platform:

- 400100 – Amazon Sales

- 400200 – Shopify Sales

- 400300 – eBay Sales

- 400400 – Etsy Sales

- 400500 – Subscription Income

- 400600 – Affiliate Revenue

This allows channel-level LTV, CAC, and ROI analysis.

COGS (500000–599999)

Think beyond product cost:

- Amazon FBA fees

- Freight, import duty

- Pick & Pack charges

- Custom packaging

- 3PL warehousing costs

Most eCom founders are off by 10–15% in margin calculations until they clean this up.

Expenses (600000–899999)

Capture your digital DNA:

- 600100 – Payment Processor Fees (Stripe, PayPal, ShopPay)

- 600200 – Marketplace Fees (Amazon, eBay)

- 600300 – Ad Spend (Meta, Google, TikTok)

- 600400 – App & SaaS Tools (Klaviyo, Recharge)

- 600500 – Freelancer/Agency Costs

Expenses are often 15–25% of total revenue. Knowing where that money’s going is key to scaling profitably.

Beyond Basics: What E-commerce Really Needs

You can’t track what you don’t label properly. Here’s where most templates fall apart:

✅ Platform Fees Are Not All the Same

Amazon takes a cut here for referrals, there for FBA, and again for storage.

eBay has listing and final value fees.

Shopify charges a % and app/plugin fees.

Solution: Create separate accounts for each platform fee type.

✅ Payment Processors Deserve Their Own Spotlight

Credit cards, PayPal, Apple Pay each with different fees.

If you’re doing $1M in revenue, you’re losing $25K–$40K to processors alone.

Solution: Break them down into distinct line items and watch for patterns.

✅ Subscription and Affiliate Revenue Aren’t Standard Sales

They follow different revenue recognition rules (especially under ASC 606).

Track them separately to ensure compliance and accurate cash forecasting.

📦 Inventory: The Silent Killer If You Don’t Track It Right

If you:

- Source from multiple suppliers

- Modify or bundle products

- Use drop shipping

- Sell internationally

…you need accounts for:

- Raw inventory

- Work in progress

- Finished goods

- Obsolete/shrinkage reserves

Most e-commerce founders learn this the hard way after a cash flow crunch.

Going Global? Add 15–20 More Accounts

International sales = more complexity. You’ll need:

- FX Gain/Loss

- GST/VAT payable (Canada, UK, EU)

- Import Duties

- Multi-currency clearing accounts

What a Good Chart of Accounts Can Unlock

- Profit per platform

- Accurate cash flow timing

- Smarter ad budgeting

- Clean tax reporting

- Faster month-end closing

Best Practices for Managing an E-commerce Chart of Accounts

Managing a chart of accounts for an e-commerce business is more than just listing transactions. It’s about creating a smart system that simplifies decision-making and scales with your business.

Core Best Practices

- Simplicity with Depth

Use a clean, scalable numbering system (like 100000–899999) that supports subcategories. This makes reporting and automation easier. - Consistency

Maintain uniform naming conventions and account structures across sales channels, currencies, and platforms. - Regular Reviews

Update your chart quarterly to reflect business growth, platform changes, or regulatory shifts. - Align with Standards

Ensure your chart complies with GAAP or IFRS as applicable—especially important for investor-readiness and due diligence. - Data Security

Use secure cloud-based accounting systems that provide role-based access and audit trails.

Automation Integration Requirements

For businesses processing over 1,000+ transactions per month, manual categorization is not scalable.

- Integrate your chart with QuickBooks, Xero, NetSuite, etc.

- Use automation rules for transaction categorization (e.g., Shopify → Sales → Payment Processor Fees).

- Structure account numbers for easy parsing by automation systems (e.g., 400100 = Amazon Revenue).

- Businesses that embrace automation reduce categorization errors by 90%.

Scalability & Growth Planning

- Reserve account number blocks for future channels like Etsy, Walmart, or international Shopify.

- Expect to add 20–30 accounts in the first 3 years of operation.

- Avoid complete restructures by planning for product line and marketplace expansion now.

Technology Integration & Data Flow

- Connect your chart with inventory tools, analytics dashboards, and payment processors.

- Ensure API compatibility, real-time sync, and easy export formats.

- E-commerce businesses that integrate their systems close books 60% faster and report with 45% higher accuracy.

International Operations & Compliance

Multi-Jurisdiction Tax Management

- US: Track nexus-based taxes across 45+ states.

- Europe: Assign VAT accounts per country.

- Canada & Australia: Allocate GST and customs duties.

- Support reverse charge, digital services tax, and proper reporting for global jurisdictions.

Currency & FX Handling

- Create separate accounts for FX gains/losses.

- Track original transaction currencies.

- Revalue foreign balances monthly to maintain profitability.

Businesses ignoring FX impacts can lose up to 5% of profitability from currency fluctuations alone.

Common Implementation Mistakes

1. Over-Complex Structures

Creating a new account for every tiny variation creates clutter. Ideal structures contain 75–125 accounts, enough for detail without chaos.

2. No Channel-Specific Tracking

Mixing revenue across platforms leads to 25%+ margin overestimates. Fix this by separating accounts by platform (e.g., Amazon Revenue vs. Shopify Revenue).

3. No Automation Planning

If you’re doing manual tagging beyond 500 transactions/month, you’re already in trouble. Design with tech in mind from day one.

| Account Number | Account Name | Account Type | E-commerce Specific | Purpose/Description |

| 101000 | Cash – Operating Account | Current Assets | Yes | Primary operating cash account |

| 102000 | Cash – Marketplace Settlements | Current Assets | Yes | Cash from marketplace sales settlements |

| 110000 | Accounts Receivable | Current Assets | Standard | Money owed by customers |

| 120000 | Inventory | Current Assets | Yes | Physical products for sale |

| 130000 | Prepaid Expenses | Current Assets | Standard | Advance payments for services/insurance |

| 139000 | Inventory Reserve | Current Assets | Yes | Reserve for potential inventory write-offs |

| 150000 | Equipment & Software | Fixed Assets | Yes | Computer equipment and software assets |

| 159000 | Accumulated Depreciation | Fixed Assets | Standard | Depreciation of fixed assets |

| 210000 | Accounts Payable | Current Liabilities | Standard | Money owed to suppliers |

| 220000 | Credit Card Payable | Current Liabilities | Standard | Credit card balances |

| 221000 | Payment Processor Payable | Current Liabilities | Yes | Amounts owed to payment processors |

| 230000 | Accrued Expenses | Current Liabilities | Standard | Unpaid expenses |

| 236100 | Sales Tax Payable | Current Liabilities | Yes | Sales tax collected from customers |

| 240000 | Deferred Revenue | Current Liabilities | Yes | Advance payments from customers |

| 241000 | Notes Payable | Long-term Liabilities | Standard | Long-term debt obligations |

| 300000 | Owner’s Equity | Equity | Standard | Owner investment in business |

| 310000 | Retained Earnings | Equity | Standard | Accumulated profits from prior years |

| 350000 | Current Year Earnings | Equity | Standard | Profit/loss for current year |

| 400100 | Amazon Sales Revenue | Revenue | Yes | Sales through Amazon marketplace |

| 400200 | Shopify Sales Revenue | Revenue | Yes | Sales through Shopify store |

| 400300 | eBay Sales Revenue | Revenue | Yes | Sales through eBay marketplace |

| 401000 | Affiliate Revenue | Revenue | Yes | Commission from affiliate programs |

| 402000 | Subscription Revenue | Revenue | Yes | Recurring subscription revenue |

| 403000 | Shipping Revenue | Revenue | Yes | Revenue from shipping charges |

| 501000 | Product Costs | COGS | Yes | Direct cost of products sold |

| 502000 | Freight & Shipping to Warehouse | COGS | Yes | Shipping costs for inventory |

| 503000 | Fulfillment Costs | COGS | Yes | Third-party fulfillment fees |

| 504000 | Packaging Materials | COGS | Yes | Boxes, labels, packaging materials |

| 505000 | Import Duties & Customs | COGS | Yes | International trade fees |

| 601000 | Payment Processing Fees | Operating Expense | Yes | Credit card and payment processing fees |

| 602000 | Platform & Marketplace Fees | Operating Expense | Yes | Amazon, Shopify, eBay fees |

| 603000 | Digital Marketing & Advertising | Operating Expense | Yes | PPC, social media, email marketing |

| 604000 | Software Subscriptions | Operating Expense | Yes | Software tools and subscriptions |

| 605000 | Shipping to Customers | Operating Expense | Yes | Outbound shipping to customers |

| 606000 | Returns & Refunds | Operating Expense | Yes | Cost of processing returns |

| 607000 | Professional Services | Operating Expense | Standard | Legal, accounting, consulting fees |

| 608000 | Technology Infrastructure | Operating Expense | Yes | Hosting, security, development costs |

| 609000 | Customer Service | Operating Expense | Yes | Support staff and tools |

| 810000 | Depreciation Expense | Other Operating Expense | Standard | Asset depreciation expense |

| 820000 | Foreign Exchange Gain/Loss | Other Operating Expense | Yes | Currency conversion gains/losses |

| 830000 | Interest Expense | Other Expense | Standard | Interest on loans and credit |

| 840000 | Bank Fees | Other Expense | Standard | Banking fees and charges |

Best Practices for Managing an E-commerce Chart of Accounts

Managing a chart of accounts for an e-commerce business is more than just listing transactions. It’s about creating a smart system that simplifies decision-making and scales with your business.

Core Best Practices

- Simplicity with Depth

Use a clean, scalable numbering system (like 100000–899999) that supports subcategories. This makes reporting and automation easier. - Consistency

Maintain uniform naming conventions and account structures across sales channels, currencies, and platforms. - Regular Reviews

Update your chart quarterly to reflect business growth, platform changes, or regulatory shifts. - Align with Standards

Ensure your chart complies with GAAP or IFRS as applicable—especially important for investor-readiness and due diligence. - Data Security

Use secure cloud-based accounting systems that provide role-based access and audit trails.

Automation Integration Requirements

For businesses processing over 1,000+ transactions per month, manual categorization is not scalable.

- Integrate your chart with QuickBooks, Xero, NetSuite, etc.

- Use automation rules for transaction categorization (e.g., Shopify → Sales → Payment Processor Fees).

- Structure account numbers for easy parsing by automation systems (e.g., 400100 = Amazon Revenue).

- Businesses that embrace automation reduce categorization errors by 90%.

Scalability & Growth Planning

- Reserve account number blocks for future channels like Etsy, Walmart, or international Shopify.

- Expect to add 20–30 accounts in the first 3 years of operation.

- Avoid complete restructures by planning for product line and marketplace expansion now.

Technology Integration & Data Flow

- Connect your chart with inventory tools, analytics dashboards, and payment processors.

- Ensure API compatibility, real-time sync, and easy export formats.

- E-commerce businesses that integrate their systems close books 60% faster and report with 45% higher accuracy.

International Operations & Compliance

Multi-Jurisdiction Tax Management

- US: Track nexus-based taxes across 45+ states.

- Europe: Assign VAT accounts per country.

- Canada & Australia: Allocate GST and customs duties.

- Support reverse charge, digital services tax, and proper reporting for global jurisdictions.

Currency & FX Handling

- Create separate accounts for FX gains/losses.

- Track original transaction currencies.

- Revalue foreign balances monthly to maintain profitability.

Businesses ignoring FX impacts can lose up to 5% of profitability from currency fluctuations alone.

Common Implementation Mistakes

1. Over-Complex Structures

Creating a new account for every tiny variation creates clutter. Ideal structures contain 75–125 accounts, enough for detail without chaos.

2. No Channel-Specific Tracking

Mixing revenue across platforms leads to 25%+ margin overestimates. Fix this by separating accounts by platform (e.g., Amazon Revenue vs. Shopify Revenue).

3. No Automation Planning

If you’re doing manual tagging beyond 500 transactions/month, you’re already in trouble. Design with tech in mind from day one.

Preparing for Operational Excellence

A well-built chart of accounts isn’t just a setup step — it’s your foundation for smart, data-backed growth. Here’s what it unlocks:

- Real-Time Profitability across channels, products, and customer segments.

- Cash Flow Forecasting that’s actually accurate — no more guessing.

- Inventory Optimization built from cost, channel, and trend-level insights.

Integrating with Business Intelligence

Your expense categories, if structured right, feed directly into your dashboards. Businesses that organize their data upfront achieve:

- 3x better CAC & LTV tracking

- 60% more efficient inventory forecasting

This structure is what tomorrow’s insights are built on.

What’s Next: Revenue Stream Mastery

Tomorrow, we’ll unpack Common E-commerce Revenue Streams — including:

- Product Sales

- Subscription Revenue

- Affiliate Commissions

- Shipping Income

Each stream requires specific classification, recognition timing, and compliance tracking. What we built today will make that easy to manage.

Key Takeaways for Day 4

- E-commerce COA needs 28+ extra accounts over standard business setups

- Multi-channel tracking is non-negotiable for profitability accuracy

- Build automation into your design from day one

- Global sellers need 15–20 additional accounts for tax & currency compliance

- Structured accounts lead to 40% faster reporting and 25% better margin analysis