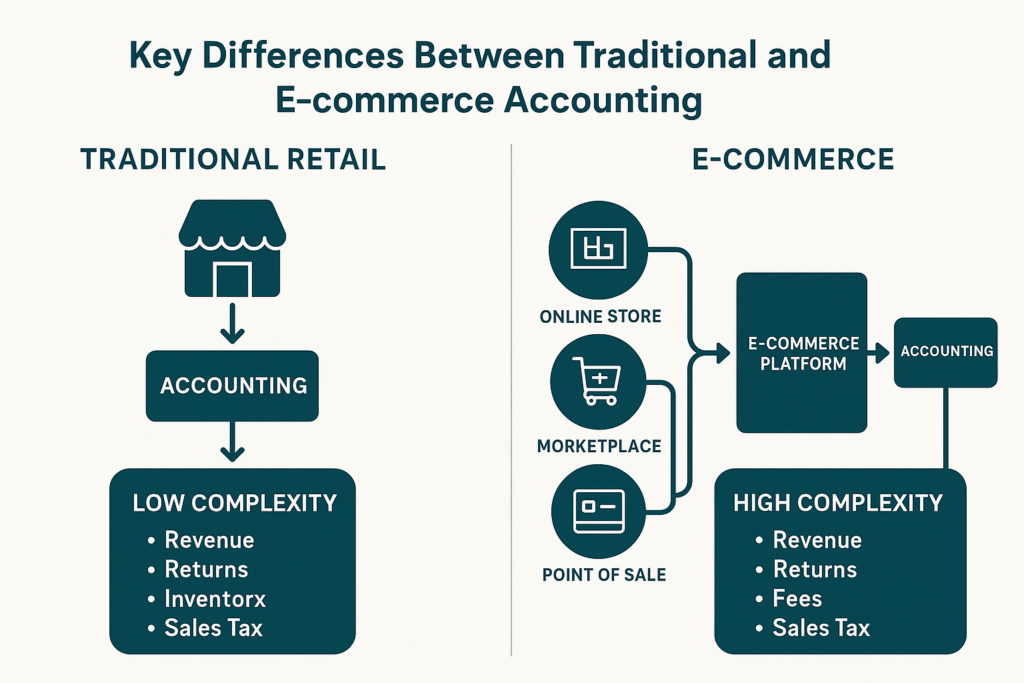

Key Differences Between Traditional and E-commerce Accounting

After understanding the unique nature of e-commerce accounting on Day 1, today’s focus is on the mechanics what specifically makes e-commerce accounting so fundamentally different from traditional accounting methods.

At first glance, both systems aim for the same outcome: accurate financial records. But beneath that surface lies a world of differences in how data moves, how systems interact, and how business owners need to think about financial management. These aren’t just tweaks they’re paradigm shifts.

It’s Not Just New Software It’s a New Way of Thinking

Most business owners assume that moving from a retail business to an online store is simply a matter of changing tools from ledgers and point-of-sale machines to cloud accounting software. But in truth, the shift requires rethinking how your financial data even works.

In traditional businesses, accounting follows a clear, linear flow: a customer walks into a store, picks up a product, pays at the counter, and receives the product immediately. One system. One transaction. One receipt.

But in e-commerce, that process is shattered into multiple steps across different digital platforms.

Imagine this:

A customer purchases a product from your Shopify store using a Visa card via Stripe. The order is fulfilled from a warehouse managed via ShipStation. The same customer later initiates a return via Amazon after seeing a better deal. Meanwhile, the payout from Stripe is delayed by three days, and Amazon deducts a return fee from your next disbursement.

That’s one customer. One order. But five different financial touchpoints.

Now multiply that by 100 orders a day spread across different marketplaces and payment providers and you begin to see why the same bookkeeping strategies that worked for your offline store start to crumble in the e-commerce world.

From Linear to Multi-Channel Transaction Flows

Traditional accounting is clean and predictable. E-commerce accounting is anything but.

In a typical brick-and-mortar business, every sale happens at one place the store. Payments are collected instantly. Inventory updates in real time at a single location. Reconciling bank transactions is a daily routine handled with ease.

Now contrast that with e-commerce:

- Sales happen on multiple platforms: Amazon, Shopify, Etsy, eBay, WooCommerce, and more.

- Each platform has different fee structures (Amazon might charge 15%, Shopify might charge 2.9% + 30¢ per transaction, and so on).

- Payment processors (like Stripe, PayPal, Razorpay, or Square) deduct their own fees and disburse funds on varied timelines.

- Orders may be fulfilled through third-party warehouses, adding more delays and cost layers.

The end result? One transaction can splinter into five or more financial data entries each with a different timestamp, value, and processing fee.

This is called data fragmentation, and if not handled carefully, it can completely distort your understanding of profitability, cash flow, and taxes owed.

The Scale Is No Longer Human-Friendly

The other major difference between traditional and e-commerce accounting is scale.

Let’s say you own a small retail shop. You’re ringing up 80-100 customers a day. Your accountant might need to review about 100 transactions a week a manageable load.

Now picture your e-commerce business during a weekend sale. You’re clocking 1,500 transactions across five platforms in 48 hours.

- That’s 1,500 payments.

- 1,500 inventory movements.

- 1,500 shipping entries.

- 1,500 revenue recognition entries.

- Multiple tax jurisdictions.

- Dozens of currency conversions if you sell internationally.

Without automated systems, keeping up with this volume isn’t just exhausting it’s impossible.

Even worse, trying to use traditional accounting methods to handle this level of activity often leads to:

- Duplicate entries

- Misapplied tax

- Delayed cash flow forecasting

- Disputes during audits

The Bottom Line

Traditional accounting was designed for a world where business happened slowly and locally. E-commerce accounting is for a world where business is fast, global, and data-heavy.

Understanding this shift from linear to fragmented, from manual to automated, and from local to multi-jurisdictional is the key to building a solid financial foundation for your online business.

Core Differences: A Comprehensive Analysis

The differences between traditional and e-commerce accounting span ten critical areas, each presenting unique challenges and opportunities. Understanding these differences is essential for making informed decisions about your accounting infrastructure and processes

Sales Channel Management

In traditional retail, managing sales channels is relatively straightforward. Most brick-and-mortar businesses operate from a single storefront, possibly supplemented by occasional phone orders or basic online listings. With only one or two income streams, tracking sales, applying fees, and reconciling accounts is a simple, direct process.

But in the e-commerce world, this simplicity disappears. Today’s online businesses often sell simultaneously on a variety of platforms Shopify, Amazon, Etsy, eBay, Instagram Shops, and their own branded websites. Each of these sales channels has its own fee structure, reporting style, settlement timeline, and tax policy. Business owners must track sales data separately for each platform while ensuring everything ties back accurately into one unified financial picture. Without an integrated system, this fragmented data can create serious challenges for profit tracking, forecasting, and tax compliance.

Payment Processing Complexity

In traditional retail, payment systems are relatively uniform. Transactions happen via a point-of-sale terminal and funds are settled instantly or within a business day. The payment methods are familiar cash, card, or checks and reconciliation is rarely complicated.

E-commerce introduces a much more fragmented and layered reality. Online businesses must support and process payments through a wide array of digital gateways such as PayPal, Stripe, Amazon Pay, Razorpay, and Square. Each of these comes with its own processing fees, settlement times, refund protocols, and backend reporting formats. Some charge flat fees, others use percentage models. Some pay out every day, others take a week or more.

And this is just the beginning. Many platforms now offer buy-now-pay-later options like Afterpay or Klarna, digital wallets like Apple Pay and Google Pay, and even crypto in some cases. All of these payment methods need to be carefully tracked, reconciled, and mapped back to each specific sale in order to get an accurate picture of business health.

Revenue Recognition Timing

Traditional businesses recognize revenue at the moment a sale is made. A customer walks in, makes a purchase, and the business immediately records that income. It’s simple and intuitive.

However, e-commerce businesses need to ask a more complicated question: When does a sale truly count as revenue? Is it at the time of order confirmation, the moment an item is shipped, or when the customer actually receives the product? Each approach has different implications for cash flow, compliance, and financial accuracy.

Accounting standards such as ASC 606 require businesses to recognize revenue only when specific performance obligations are met. This means online retailers need to evaluate whether shipping or delivery completes the transaction. For instance, if a customer cancels after shipment but before delivery, the timing of recognition becomes even more critical. Proper revenue recognition policies are essential for avoiding overstated profits and potential audit risks.

Inventory Management Systems

Traditional retail inventory is centralized and often managed manually. A single store might perform physical stock checks once a month, update the inventory ledger, and adjust purchase orders as needed.

In contrast, e-commerce businesses operate in a distributed, dynamic environment. Products are stored in multiple warehouses or third-party fulfillment centers, often located in different cities or countries. Inventory is listed across various sales platforms, each pulling data from the same limited stock pool.

Real-time tracking becomes essential. Every sale, return, or product movement must reflect instantly across systems to prevent overselling or stock-outs. Failure to do this not only affects the customer experience but also distorts financial data, especially cost of goods sold (COGS) and margin analysis. To stay competitive, e-commerce businesses must implement smart inventory systems that integrate with both their sales channels and accounting platforms.

Tax Compliance: A New Level of Complexity

Multi-Jurisdiction Challenges

In traditional business models, tax compliance is usually restricted to the city and state where the company operates. A retail shop on Main Street only needs to worry about collecting and remitting taxes within that jurisdiction.

E-commerce changes the game entirely. Once a business starts selling online, it may become liable to collect and remit sales tax in dozens of different states based on economic activity rather than physical presence. This shift stems largely from the 2018 South Dakota v. Wayfair decision, which gave states the legal authority to require sales tax collection from out-of-state sellers once they cross specific revenue or transaction thresholds.

For example, if an online business exceeds $100,000 in sales or 200 transactions in a particular state, it may need to register, collect, and file sales tax in that state even if it has no warehouse, office, or employees there. Managing this requires diligent tracking of where customers are located, understanding of ever-changing tax laws, and automated systems to ensure compliance.

International Complexity

Selling globally adds another layer of tax difficulty. International e-commerce sellers must deal with different regulatory environments, each with their own set of tax rules. In the European Union, for instance, Value Added Tax (VAT) must be applied differently depending on where the customer is located and how much the seller earns from that market. Australia and Canada impose Goods and Services Tax (GST) rules with similar complexity.

Additionally, import duties, customs paperwork, and foreign tax registration can make cross-border sales a logistical nightmare. Each country may have different thresholds for requiring tax collection, unique forms to file, and language barriers to navigate.

Failing to comply with international tax laws can result in delayed shipments, fines, or even the suspension of selling privileges on key marketplaces. Businesses looking to expand internationally need dedicated accounting support or software that can automatically calculate and collect the correct tax for each transaction, based on product category, buyer location, and order value.

Here’s the rewritten and expanded version of your section, retaining a detailed, professional tone with human readability, and avoiding any em-dash usage:

Technology Requirements: The Great Divide

Automation Is Not a Luxury It’s a Lifeline

In the world of traditional retail accounting, many processes are still manual. Basic software like Tally, QuickBooks Desktop, or spreadsheets can get the job done when transaction volumes are low and the business model is linear. Monthly reconciliation, manual ledger entries, and quarterly financial reviews often suffice for local retail stores or small service businesses.

But for e-commerce businesses, this approach simply doesn’t hold up. The sheer volume of transactions, along with their fragmented origins across Shopify, Amazon, Etsy, WooCommerce, and more makes manual accounting not only inefficient but dangerously prone to error.

To handle this digital chaos, automation becomes indispensable. E-commerce accounting automation can reduce data entry errors by up to 90 percent and save businesses between 40 and 60 hours each month. These tools auto-import sales, sync with inventory platforms, reconcile bank and gateway payments, and generate real-time financial reports across multiple dimensions like channels, products, or regions.

Automation doesn’t just save time. It provides the foundation for strategic decision-making. Without it, most online businesses are essentially reacting in the dark unable to scale, forecast, or detect early warning signs before they become disasters.

Integration Requirements

E-commerce businesses rely on a tech stack, not a single tool. Success means weaving together a system where your online storefronts, inventory systems, payment gateways, CRM tools, and accounting platforms speak the same language automatically and continuously.

This integration is not a convenience; it’s critical for survival. Without tight connections between systems, you risk financial misstatements, stock inaccuracies, tax compliance failures, and a general loss of control.

Traditional businesses might use one or two tools that rarely need updates. E-commerce businesses, in contrast, operate in an environment that evolves daily. Platforms update APIs, rules change, payment methods shift, and tax jurisdictions evolve. Your accounting systems must adapt just as fast. That’s why cloud-based, modular, and scalable accounting systems are the future of e-commerce finance they can keep up with the pace of change while maintaining data integrity across the ecosystem.

Financial Reporting and Analysis: Real-Time vs. Historical

From Quarterly Snapshots to Minute-by-Minute Visibility

Traditional accounting cycles are designed for stable business models. Monthly or quarterly reporting offers a decent picture of financial health for stores with predictable footfall and sales trends.

E-commerce, however, doesn’t run on predictable cycles. Algorithms change overnight, viral posts can drive a week’s worth of traffic in minutes, and inventory can vanish faster than it arrives. This creates an urgent need for real-time financial visibility.

E-commerce founders and finance teams need access to updated dashboards showing KPIs like:

- Gross margins by product category

- Channel-wise profitability

- Customer acquisition cost vs. customer lifetime value

- Conversion rates and abandoned cart values

- Real-time revenue and expense tracking

Waiting for a monthly report can mean missing the opportunity to fix a bleeding channel or double down on a trend. That’s why e-commerce accounting systems must support dynamic reporting so decision-makers can act fast, not just reflect later.

Multi-Channel Performance Analysis

Brick-and-mortar businesses typically operate from one physical location, maybe two. Their performance metrics are usually centered around in-store sales, foot traffic, and overhead expenses. Analysis is straightforward.

But e-commerce businesses operate across multiple digital fronts at once. Your Shopify store might be outperforming Amazon in margins, but underperforming in volume. Facebook Ads might be burning cash, while SEO drives high-converting traffic.

To understand where profits are made or lost, you need granular visibility across:

- Sales channels (Amazon, Etsy, Website)

- Product categories and SKUs

- Regions and countries

- Customer cohorts or acquisition sources

- Fulfillment centers and logistics providers

This multi-dimensional analysis helps uncover powerful insights, like which products perform better on certain platforms, or which regions have the highest returns. Without this depth of reporting, e-commerce businesses risk flying blind spending heavily on underperforming areas or missing high-growth opportunities.

Cash Flow Management Complexity

Payment Timing and the Illusion of Profit

Cash flow management is often cited as the top reason businesses fail and in e-commerce, it’s an especially tricky beast. In traditional retail, the process is clean: a sale happens, cash is received instantly, and that money can be used for operations or reinvestment.

In e-commerce, sales and cash are disconnected. Here’s what that typically looks like:

- A customer makes a purchase on your Shopify store.

- The money goes to Stripe or Razorpay.

- That payment processor deducts fees and holds the funds for 1 to 3 business days.

- Some platforms, like Amazon, release payouts only on a biweekly schedule.

- Add to that the impact of refunds, chargebacks, return logistics, and delayed currency conversions if you’re selling internationally.

This means while your accounting system might show healthy sales, your bank balance tells another story. If you’re not forecasting your incoming cash correctly or understanding your cash flow cycle you might run out of money while your books show a profit.

Proper cash flow management in e-commerce involves:

- Tracking platform-specific payout timelines

- Accounting for refund trends and return windows

- Forecasting large cash needs for inventory purchases

- Planning for ad spend spikes during promotions or holidays

- Managing credit terms with suppliers while waiting on payouts from marketplaces

It’s not just about selling more. It’s about timing every rupee and dollar so your operations keep flowing, your campaigns stay funded, and your business stays alive.

| Aspect | Traditional Accounting | E-commerce Accounting |

| Sales Channels | Single or few channels (physical store, phone orders) | Multiple channels (website, Amazon, eBay, social media, marketplaces) |

| Transaction Volume | Lower volume (50-200 transactions daily) | High volume (thousands of transactions daily) |

| Payment Processing | Cash, checks, single POS system | Multiple payment gateways, digital wallets, BNPL services |

| Revenue Recognition | Immediate recognition at point of sale | Complex timing – shipping vs delivery point recognition |

| Inventory Management | Physical stock counts, single location | Real-time tracking across multiple warehouses and channels |

| Tax Compliance | Local/state tax obligations | Multi-jurisdiction nexus, international VAT, economic nexus laws |

| Technology Requirements | Basic accounting software, manual processes | Advanced automation, multi-platform integrations, cloud-based systems |

| Financial Reporting | Monthly/quarterly reporting cycles | Real-time reporting, multi-channel performance analysis |

| Cash Flow Management | Immediate cash receipt | Delayed settlements, payment processor holds, marketplace timing |

| Data Management | Centralized, single-source data | Fragmented across platforms, requires consolidation |

The Strategic Implications

Understanding the differences between traditional and e-commerce accounting isn’t just an academic exercise it directly affects the strategic decisions that shape your business’s financial health and long-term viability. The operational complexity, regulatory challenges, and data fragmentation inherent in e-commerce demand more than just basic bookkeeping. They require a fundamental shift in how you approach financial management.

Failing to upgrade your accounting systems to reflect these realities can silently derail growth, distort financial visibility, and ultimately lead to poor decision-making. The result is often the same sobering outcome that plagues 80 to 90 percent of online businesses failure due to mismanaged cash flow, compliance issues, or lack of accurate insights.

To avoid this fate, businesses must recognize accounting as a strategic function not just a backend process. Proactive investment in robust systems, tools, and talent is not optional. It’s the foundation on which scalable and sustainable e-commerce success is built.

Preparing for the Transition

Assessment and Planning

Before you can build, you must assess. Begin by evaluating your current accounting framework against the requirements of a modern e-commerce environment. This includes examining your:

- Existing accounting software and whether it integrates with platforms like Amazon, Shopify, or WooCommerce

- Payment processor compatibility and reporting access

- Inventory tracking systems and their alignment with sales channels

- Tax compliance preparedness, both domestic and international

- Staff’s familiarity with digital accounting tools and workflows

This assessment should also include a review of risks, such as manual processes, fragmented reporting, delayed reconciliations, or unclear revenue recognition practices. Without a clear understanding of where you are today, building a future-ready financial operation becomes guesswork.

Building the Foundation

Once gaps are identified, the next step is to create a structured roadmap. This includes:

- Selecting accounting software specifically designed or customizable for e-commerce

- Automating transaction imports, reconciliations, and tax calculations

- Setting up integrations with all your sales channels and payment gateways

- Training your internal team or outsourcing to specialists who understand the nuances of digital commerce

- Establishing real-time dashboards to monitor KPIs like gross margin by channel, return rates, and CAC-to-LTV ratios

This foundational work is what enables consistency, transparency, and scalability in your operations. It transforms accounting from a reactive process into a strategic enabler that can support aggressive growth targets.

What’s Next: Understanding the E-commerce Sales Cycle

In tomorrow’s session, we’ll explore the complete E-commerce Sales Cycle, often referred to as the “Order to Cash” process. This cycle includes every financial checkpoint from the moment a customer places an order to the point when money actually appears in your business’s bank account.

We’ll dissect each stage from order confirmation and inventory deduction to payment processor settlements and refund handling and explain how these touchpoints shape your revenue recognition, cash flow management, and financial accuracy. By mapping this journey, you’ll begin to understand why e-commerce accounting is not just about tracking what is sold, but when, how, and where the financials reflect it.

Key Takeaways from Day 2

- E-commerce accounting operates at a much higher level of complexity than traditional retail accounting, demanding more sophisticated tools and processes.

- The digital nature of e-commerce introduces fragmented data sources, which require real-time integration and reconciliation to produce reliable financial reports.

- Tax compliance is no longer a local concern. Businesses must be prepared to handle multi-state sales tax, international VAT, and economic nexus obligations.

- Cash flow management in e-commerce must account for platform-specific payment delays, returns, and chargebacks, which are less prevalent in traditional business models.

- Automation is essential not just for efficiency, but to avoid critical errors and ensure strategic financial control.

Coming Up Tomorrow

We’ll guide you through the E-commerce Order to Cash Cycle. This will give you a practical lens on how your sales activities translate into accounting events and impact your business’s financial position. It’s one of the most critical frameworks any e-commerce founder, CFO, or accountant must understand to make timely, informed decisions.