The Brutal Truth First:

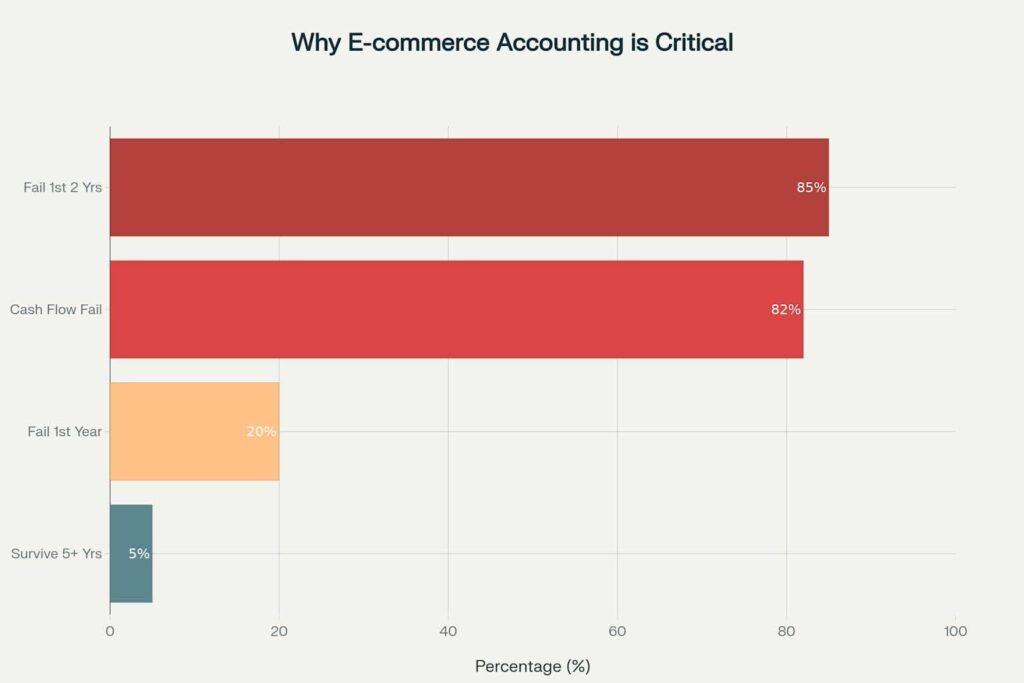

Let’s begin with a hard truth: Most e-commerce businesses don’t make it. And it’s not because of bad products or poor marketing it’s because of bad accounting.

Before we get into the how-to of managing your e-commerce books, we need to confront something most business owners learn too late. Nearly 80-90% of e-commerce businesses shut down within the first two years. That’s not just a startup statistic it’s a survival reality. Even more alarming? 82% of those failures are directly tied to cash flow mismanagement.

These aren’t just numbers. They’re red flags.

Many founders assume that strong sales or viral marketing will carry their business forward. But in the absence of structured, proactive financial oversight, even the most promising ventures can spiral into debt, tax issues, or inventory chaos.

E-commerce is fast-paced. But if your accounting can’t keep up, your business won’t either.

At Centflow Global, we’ve worked with businesses at every stage from thriving brands to those on the verge of collapse. And the difference between the two? It almost always comes down to how well they understand and manage their numbers.

This 28-day series is your roadmap not just to “do accounting,” but to build a business that’s financially bulletproof. Because in the world of online commerce, proper accounting isn’t a back-office chore. It’s a survival strategy.

The Numbers Don’t Lie Accounting Isn’t Just Support, It’s the Lifeline

Let’s put the scale of this industry into perspective.

Global e-commerce sales are expected to cross $6.42 trillion by 2025. That’s not just growth it’s a tidal wave of opportunity. But here’s the uncomfortable truth: only 5% of e-commerce businesses will still be around five years from now.

Let that sink in. While millions jump into the market with high hopes, 95% won’t make it.

And when you dig into why these businesses fail, it’s not product quality or lack of demand. It’s not even competition in most cases. Time and again, it comes back to one missing piece: sound financial management.

At Centflow Global, we’ve seen this play out across every scale. Founders launch with passion, scale rapidly, and then somewhere along the line lose grip on their financial systems. Margins get distorted, inventory goes unchecked, returns aren’t accounted for properly, and taxes pile up unexpectedly. Suddenly, the business that looked successful on the outside starts breaking down from the inside.

Why E-commerce Accounting Isn’t Just a Variation It’s a Whole Different Game

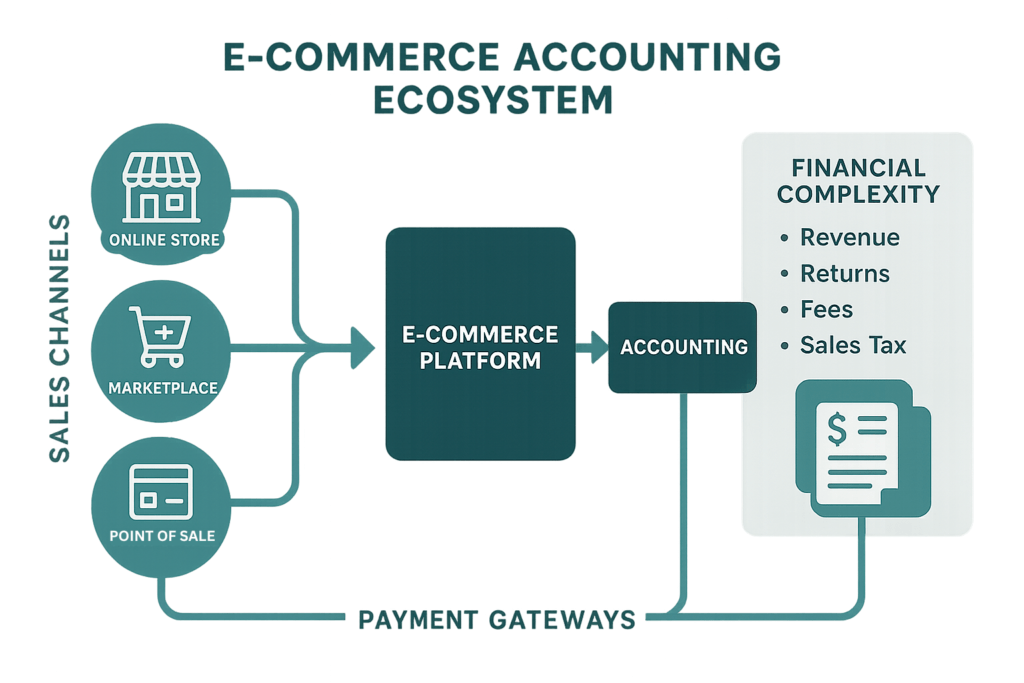

There’s a reason traditional accounting practices don’t hold up in the e-commerce world.

The Digital Commerce Revolution has fundamentally changed how transactions are recorded, processed, and reported. Brick-and-mortar stores usually operate from one location, with face-to-face cash or card transactions, a simple POS system, and local tax rules. Accounting in that world is relatively linear and location-bound.

Now contrast that with an e-commerce business.

- It might sell on Amazon, Shopify, Etsy, Flipkart, and eBay all at the same time.

- Orders come from across countries, time zones, and currencies.

- Payments are processed through Stripe, PayPal, Razorpay, and dozens of other gateways, each with different settlement timelines and fees.

- Refunds, discounts, commissions, ad spends all of it is distributed across platforms, making visibility a massive challenge.

An offline business might handle 50 transactions a day. An online business could handle 5,000 across 6 platforms in real-time.

What does that mean for accounting?

It means a basic cash-flow sheet or quarterly profit report just won’t cut it. You need automated systems, consolidated dashboards, and real-time reconciliation to even stay afloat let alone grow.

And that’s exactly why e-commerce accounting deserves its own playbook. Not a templated version of traditional bookkeeping, but a tailored, tech-enabled system that can handle the chaos of digital commerce with precision.

The Real E-commerce Battlefield: 8 Accounting Challenges You Can’t Ignore

Behind the glossy ads, creative packaging, and trending hashtags lies the harsh backbone of every successful e-commerce business: financial clarity. What makes e-commerce accounting so uniquely challenging is not just the volume but the velocity, variety, and vagueness of data flowing through countless digital pipes.

To understand this better, let’s break it down into the 8 most critical accounting challenges e-commerce businesses face today and why ignoring even one of them can quietly sabotage your entire business.

| Challenge | Why It Matters | What Happens If You Ignore It |

| 1. Multi-Channel Sales | Shopify, Amazon, Etsy, etc. all report differently | Your P&L becomes a confusing mess |

| 2. Payment Gateways | Stripe, PayPal, etc. settle money on different schedules | Your cash flow looks fine — until it’s not |

| 3. Inventory Tracking | Inventory must be synced across platforms in real-time | Overselling, overstocking, and cost issues |

| 4. Tax Compliance | Multiple states/countries, all with unique tax laws | Risk of audits, penalties, and blocked accounts |

| 5. Data Fragmentation | Your data lives in 10 different places | Bad decisions from incomplete information |

| 6. Transaction Volume | Thousands of orders daily = bookkeeping chaos | Errors compound, systems crash |

| 7. Global Sales | Currency conversion and international taxes | Hidden losses, FX fees, or double taxation |

| 8. Returns & Refunds | High return rates = complex revenue recognition | Bad books, unhappy customers |

1. Multi-Channel Complexity

Selling across Amazon, Shopify, Etsy, eBay, your website, and social media sounds like a growth hack. But in accounting terms, it’s a data nightmare.

Each platform has:

- Unique reporting formats

- Different fee deductions

- Disjointed payout schedules

- And distinct sales tax logic

This leads to confusion in determining true profit margins, calculating revenue by channel, and reconciling bank deposits. Without a centralized system to consolidate and interpret this data, founders often end up with distorted views of performance. It’s like looking at your business through a cracked lens.

The Cost of Ignorance: Misstated profits, mismatched bank entries, and inaccurate tax filings that can trigger audits or penalties.

2. Payment Processing Pitfalls

Stripe. PayPal. Razorpay. Amazon Pay. Each payment gateway charges different fees, settles at different intervals, and formats their reports differently.

In traditional businesses, reconciling payments is straightforward. In e-commerce, it becomes a full-time job.

Most founders glance at the net payouts and assume that’s revenue without accounting for:

- Processing fees

- Refund deductions

- Currency conversions

- Chargebacks

This leads to misreporting of both income and expenses, skewing everything from cash flow to gross margins.

The Real Risk: Short-term cash shortages, misinterpreted performance, and under-reported liabilities.

3. Real-Time Inventory Management

In e-commerce, inventory is never stationary. It’s moving in and out of:

- Multiple warehouses

- 3PL partners

- Dropship vendors

- And multiple marketplaces all in real time.

Without tight integration between your inventory systems and your accounting software, you’ll either:

- Oversell products and lose customer trust

- Or overstock and freeze your working capital

Additionally, incorrect COGS (Cost of Goods Sold) entries caused by poor inventory syncing can completely distort profitability reports.

The Fallout: Burnt capital, ghost stock, or worse misinformed pricing decisions that sink your margins.

4. Tax Compliance Chaos

Here’s where it gets messy.

In traditional business, you charge tax based on your store’s location. In e-commerce, your tax obligation could be in every state or country where you sell thanks to economic nexus laws and marketplace facilitator rules.

Now add in:

- Sales tax vs. VAT

- GST registration thresholds

- Country-specific filing formats

- Currency conversion impact on filings

Missing one obligation can result in fines, interest, reputational damage, and even platform suspensions.

Bottom Line: If your tax setup isn’t automated, up-to-date, and well-advised you’re walking a compliance tightrope.

5. Data Fragmentation

Sales on Shopify. Fees on Stripe. Refunds on PayPal. Payouts through Razorpay. Ad spends in Meta. Inventory in Zoho.

You get the idea.

Data is scattered across tools, platforms, and spreadsheets. Without a way to consolidate this ecosystem, you’re operating with fragmented visibility.

And when data is fragmented:

- Decisions become reactive instead of strategic

- Reports become inconsistent and unreliable

- Your CPA or bookkeeper spends hours cleaning instead of advising

The Invisible Danger: Business owners flying blind, acting on outdated or partial data and making decisions that hurt growth.

6. High Transaction Volume

E-commerce doesn’t sleep. During sales, festivals, or marketing spikes, transaction volume can shoot up overnight.

Thousands of orders can translate to:

- Thousands of accounting entries

- Dozens of refunds, partials, and chargebacks

- Massive reconciliation workloads

Traditional bookkeeping systems (and humans) aren’t built for this. Delays in reconciliation = missed red flags in financial health.

The Risk Multiplier: Scaling your business without scaling your accounting setup = chaos in disguise.

7. Currency & Geography

International sales = international complications.

Each sale may involve:

- Currency conversion (with fluctuating exchange rates)

- Local taxes (VAT, GST, customs)

- Cross-border shipping charges

- Foreign payment gateways

And then there’s reporting:

- Do you report in base currency or invoice currency?

- When do you account for exchange gains/losses?

- What’s your FX treatment policy?

If mismanaged: You either overstate revenue, absorb FX losses silently, or under-report taxable income—none of which ends well.

8. Returns & Refunds Accounting

Let’s be real e-commerce has a high return rate, especially in fashion, electronics, and seasonal goods.

Each refund requires:

- Reversing revenue

- Reinstating inventory (or writing it off)

- Adjusting taxes collected

- Reconciling refund-related gateway deductions

But most sellers don’t update their books for returns in real time. That means:

- Revenue gets overstated

- Profit margins look inflated

- Customer disputes pile up

The Untold Cost: Skewed metrics, messy audits, and loss of trust with customers and stakeholders alike.

And in e-commerce, where things change by the hour, you need that GPS running 24/7.

Why Proper E-commerce Accounting Is Business-Critical

For an industry that prides itself on innovation, e-commerce businesses often overlook the one thing that determines their long-term survival: financial clarity.

Financial Visibility That Drives Decisions, Not Just Reports

Imagine trying to scale a business where you don’t know:

Whether you’re scaling a Shopify store, managing an Amazon FBA business, or juggling international orders across platforms, your accounting system is more than just compliance—it’s the core operating system of your business. Let’s break down why proper e-commerce accounting is not just helpful—but absolutely mission-critical.

- Which products are truly profitable

- Where your ad spend is leaking

- Or which channel is quietly bleeding you dry

That’s what happens when e-commerce accounting is treated as an afterthought.

Modern e-commerce moves fast. Decisions around pricing, restocking, advertising, and fulfillment happen daily. If you’re relying on quarterly or even monthly reports, you’re operating with stale data in a real-time world.

Proper e-commerce accounting empowers you to:

- Track Customer Acquisition Costs (CAC) by platform

- Monitor Lifetime Value (LTV) per customer cohort

- Compare Gross Profit Margins per SKU or channel

- Assess Cash Conversion Cycles across different marketing pushes

Without this visibility, founders make decisions in the dark—and usually pay for it later with slim margins, lost scale opportunities, or worse, unsustainable growth.

At Centflow Global, our clients don’t just receive reports—they gain the clarity to make bold, profitable moves with confidence.

2. Cash Flow Management in a Delayed-Revenue World

Cash flow in e-commerce is unlike any other industry.

You make the sale today, but your money may not hit the account for days—or even weeks—depending on:

- The payment processor’s settlement delay

- The marketplace’s payout cycle

- The impact of returns, disputes, and chargebacks

Meanwhile, your ad costs are paid upfront, your inventory vendor needs payment on dispatch, and customer support costs don’t pause.

This creates a fragile cash flow ecosystem where:

- One delayed Amazon payout can disrupt your reordering cycle

- A sudden spike in returns can collapse your cash buffer

- Over-ordering inventory can lock up critical working capital

Proper e-commerce accounting introduces cash flow forecasting, enabling you to plan ahead, spot timing mismatches, and avoid those “we had sales but no cash” moments.

Centflow’s forecasting models are designed specifically for e-commerce timelines—because cash today matters more than revenue tomorrow.

3. Compliance and Risk Management in a Borderless Market

As soon as your product sells across state or national lines, your compliance burden multiplies.

From U.S. sales tax nexus laws to international VAT registration, e-commerce founders must juggle:

- Varying tax rates, rules, and return schedules

- Marketplace facilitator laws that shift responsibilities midstream

- Consumer protection laws that differ from region to region

- Foreign currency compliance in multi-currency environments

And unlike traditional brick-and-mortar businesses, you may owe taxes in jurisdictions where you have no physical presence just based on economic thresholds.

Improper filings, late registrations, or even misreporting can result in:

- Frozen funds from marketplaces

- Costly penalties and audits

- Legal complications across borders

At Centflow, we help e-commerce brands proactively manage multi-jurisdiction compliance so they can scale without fear of financial blind spots.

4. Why Automation Isn’t Optional It’s Survival

Let’s face it: manual bookkeeping is dead.

In e-commerce, where you’re dealing with:

- Thousands of micro-transactions

- Frequent pricing and discount changes

- Multiple currencies and platforms

- Daily ad spend fluctuations

Trying to manage your books manually is like trying to row a ship during a storm—blindfolded.

Here’s where automation transforms survival into scale.

With the right stack, automation can:

- Pull real-time data from Shopify, Amazon, Stripe, PayPal, etc.

- Auto-reconcile bank feeds with invoices and payouts

- Match refunds and returns across inventory and sales reports

- Calculate sales tax/VAT based on geography and laws

- Sync multi-currency transactions with live exchange rates

This isn’t about replacing humans. It’s about freeing up human time for high-value tasks—like strategy, forecasting, and tax planning.

Centflow Global combines automation with human oversight, delivering accuracy at scale and the expertise to act on it.

The E-commerce Accounting Readiness Checklist

Want to know where your business stands?

Use the checklist below to assess your current readiness level:

▸ Basic Financial Setup

- Separate business bank account in place

- Business credit card used solely for ops

- Cloud-based accounting software set up

- E-commerce-specific chart of accounts

- Weekly or bi-weekly bookkeeping schedule

▸ Sales Channel Management

- All sales platforms integrated (Shopify, Amazon, etc.)

- Fee structures for each platform understood

- Standardized payout reconciliation process

- Cross-platform performance tracked

- Inventory sync between store and warehouse

▸ Payment Processing Readiness

- All gateways connected to accounting software

- Fee + timing matrix built for each gateway

- Chargeback & refund workflow established

- Multi-currency handling documented

- Auto-reconciliation of payment data enabled

▸ Financial Monitoring & Analysis

- Core KPIs defined (CAC, LTV, Gross Margin, etc.)

- Weekly and monthly reporting cadence followed

- Rolling cash flow forecasts generated

- Profitability tracked per product and channel

- Budget vs. actual comparisons used for decision making

▸ Compliance & Legal Preparedness

- Registered for sales tax or VAT in relevant regions

- Understanding of foreign tax laws and thresholds

- Secure document storage and record retention

- Audit checklist and process in place

- Professional financial advisor engaged

▸ Automation & Operational Efficiency

- Manual processes identified and automated

- Daily backups and security protocols active

- Automated error-flagging rules applied

- Staff trained on system use and SOPs

- Monthly system checks and updates performed

Scoring:

0–9 Checks: Urgent action needed. Start with foundational accounting setup and compliance.

21–24 Checks: You’re in great shape. Time to explore forecasting, analytics, and tax strategy.

15–20 Checks: You’ve built a good base—now focus on filling the gaps and improving automation.

10–14 Checks: You’re operational, but risk exposure is high. Address weak spots immediately.

What Your Score Actually Means (And What to Do About It)

You’ve assessed your e-commerce accounting setup. Now comes the important part—acting on it. Here’s what your score reveals about your financial foundation and the exact next steps you need to take.

✅ Score: 20–24

You’re not just surviving. You’re ready to scale.

You’ve built a strong foundation—clean books, automation, reporting systems, and compliance in check. Now it’s time to shift your accounting from reactive to strategic.

Your Next Steps:

- Implement predictive analytics to anticipate cash flow dips and seasonal trends

- Deep-dive into product-level profitability and cohort performance

- Set up advanced dashboards for real-time insights

- Audit your automations for blind spots—improve accuracy, not just efficiency

🎯 Centflow Tip: Explore KPI alerts that notify you when profit margins drop or ad spend spikes—this is how elite brands make quick, confident decisions.

⚠️ Score: 15–19

You’ve got the engine now fine-tune it before things go off track.

You’ve covered the basics but have a few loose ends that could cause bigger issues as you scale. These are the early warning lights—ignore them, and they turn into breakdowns.

Your Next Steps:

- Address all unchecked items within the next 30 days

- Consider booking a professional audit or consultation

- Implement key integrations (payment platforms, inventory, tax tools)

- Start using weekly financial reports—not just end-of-month reviews

🚨 Centflow Tip: Run a “leak check” by comparing payouts vs. platform statements. You’ll often uncover fee mismatches or revenue leakage hiding in plain sight.

🟡 Score: 10–14

You’re operating but at risk. Time to fix the cracks before you scale.

Your current setup may be keeping things afloat, but it’s fragile. One platform change, one tax notice, or one viral product could break the system. This is the “danger zone” where many fast-growing brands stall or collapse.

Your Next Steps:

- Focus on high-impact gaps first (e.g., platform reconciliation, tax compliance)

- Hire a bookkeeping partner with e-commerce expertise

- Get basic automation tools in place—manual tracking won’t scale

- Build a consistent reporting rhythm (weekly is ideal)

🧩 Centflow Tip: Focus on reducing manual decisions. Every spreadsheet entry is a potential error—and a time sink.

🔴 Score: 0–9

You’re in the red zone and one bad quarter from disaster.

You’re likely managing your finances manually, without visibility, systems, or safeguards. This is the stage where even profitable businesses run out of cash, miss tax filings, or face irreversible compliance issues.

Your Next Steps:

- Prioritize immediate action seek professional help without delay

- Fix the legal and tax compliance issues first (penalties stack fast)

- Get your books cleaned up and start fresh if necessary

- Establish foundational controls: business bank accounts, chart of accounts, accounting software, and SOPs

🆘 Centflow Tip: We’ve helped businesses rebuild from the ground up. Sometimes, resetting with clean books is faster and smarter than trying to untangle the mess.

Setting the Foundation for E-commerce SuccessUnderstanding that e-commerce accounting is not just a variation of traditional accounting

but an entirely different beast is your first real step toward building a sustainable business. Today’s breakdown of complexity

from multi-channel sales and payment processor fragmentation to tax compliance and inventory chaos

should make one thing clear: mastering e-commerce accounting requires more than general knowledge. It demands a system.That’s exactly what we’ll help you build over the next 27 days.

This series is designed to give you not just theory, but a daily roadmap. Each entry will build on the last, layering in complexity and giving you the practical tools to turn confusion into clarity

and accounting chaos into confidence.Because here’s the truth the stats don’t sugarcoat:

- 95% of e-commerce businesses will not survive.

- And 82% of failures will stem from financial mismanagement.

The difference between the businesses that scale and those that shut down often comes down to one choice

whether or not they built the right financial foundation early.By reading this, you’re already ahead.

What’s Next?

Tomorrow, we begin with one of the most important distinctions: the Key Differences Between Traditional and E-commerce Accounting.

We’ll take you behind the scenes to compare how e-commerce transforms the fundamentals—transaction processing, revenue recognition, inventory flow, and platform-based reporting. You’ll understand why old-school methods fail in a digital-first environment—and how to modernize your approach for scale.

Day 1 Summary Key Takeaways

- E-commerce accounting isn’t traditional accounting. The digital ecosystem introduces entirely new systems, flows, and problems.

- Most e-commerce failures are financial. 80-90% of online businesses fail, and poor accounting is a core reason.

- Eight core challenges define e-commerce accounting. These range from inventory sync and multi-channel reconciliation to return logic and tax complexity.

- Automation isn’t optional. If you want to survive the scale of digital commerce, your systems must do the heavy lifting.

- Financial clarity drives better decisions. In e-commerce, timing is everything—real-time visibility equals better moves.

Stick with us. By the end of this journey, you won’t just know what makes e-commerce accounting uniqu

you’ll know exactly how to master it.Want to shortcut the process?

Reach out to Centflow Global today and let our experts help you build a tailored accounting system that supports your growth before inefficiencies start costing you real money.

Want help getting your e-commerce accounting right?

Let’s talk — no pressure, no jargon.

📞 +1 3159612634

🌐 info@centflowglobal.com